TQ Evening Briefing

Wall Street broke records, oil crashed, and Powell’s crew lost its compass. Add fresh Epstein leaks, and you’ve got peak Beltway volatility.

AFTER THE BELL

Something big snapped back to life on Wall Street today, and it’s not clear the market’s ready for it.

After weeks of drift and shutdown gloom, the tape suddenly lit up.

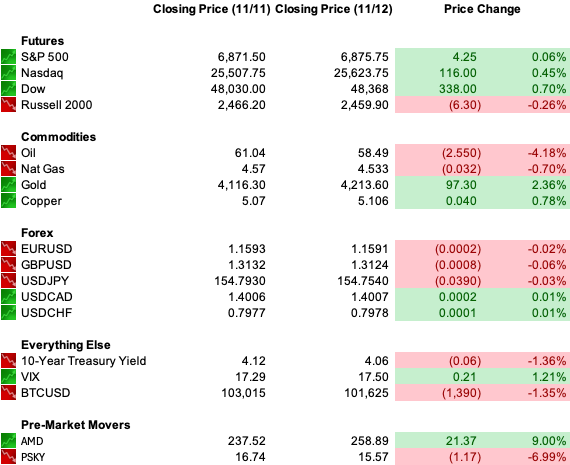

The Dow ripped higher into the close, up and notching a fresh record above 48,000 as traders bet the 43-day government shutdown finally dies this week. The S&P 500 barely budged and the Nasdaq slipped 0.50% — a rotation day, plain and simple.

Banks and old-school cyclicals ran the show. Goldman, JPMorgan, and AmEx, all printing new highs as yields cooled and reopening optimism pulled money back into balance-sheet land.

Caterpillar and the industrials climbed in sympathy. The XLF tacked on a full percent. On the flip side, big tech gave some back: Palantir, Oracle, Meta, Tesla all lower. AMD broke ranks with a 7% rip higher, proving the AI trade isn’t dead… just bipolar.

Commodities threw their own curveball: gold up 2.06%, oil down 4.31%.

OPEC held its demand line, inventories ticked up, and traders pulled bids fast. The VIX barely twitched but hedging activity picked up into the close.

No real data today as the shutdown blackout continues, but the old prints still hang in the backdrop: CPI +0.3%, unemployment 4.3%, inflation cooling while the jobs engine sputters.

Once D.C. reopens, expect a firehose of delayed data to hit terminals and confuse everyone for at least a week.

Tomorrow’s lineup is loaded: Disney, Alibaba, Applied Materials, JD.com, Brookfield, Williams-Sonoma… basically every major pocket of the global economy reporting within 24 hours.

Strap in.

Premier Feature

Forget AI, This New Tech is Projected to Grow 3x Faster

President Trump's new law #S.1582 unlocks a new tech that could trigger a $21 trillion financial revolution.

And said that it represents "American brilliance at its best."

Click here to see the details because the market for this tech…

Is projected to grow more than THREE times FASTER than AI in the coming years.

MONETARY PULSE

Markets are betting the Fed cuts again in December, even as Powell’s team splinters over whether the data fog justifies another move.

A fresh Reuters poll shows 80% of economists expect a 25 bps trim next month, taking the target range to 3.50–3.75%... the third consecutive cut.

Consensus blames a softening labor market and a fading growth impulse: GDP likely slowed this quarter from the last, while unemployment is projected to tick up in 2026.

But the Fed’s dual mandate is getting noisier.

Inflation, measured by core PCE, has sat above 2% for over four years — the longest streak since 1995 — raising credibility questions as tariffs and energy costs threaten to embed price stickiness.

Economists see the Fed boxed in between an underpowered job engine and inflation fatigue that refuses to fade. “It’s not collapsing, but it’s cooling,” said BofA’s Stephen Juneau, summing up the uneasy middle ground.

Meanwhile, the institution itself faces political risk.

The Supreme Court will hear arguments Jan. 21 on Trump’s bid to fire Fed Governor Lisa Cook, who he accused (without proof) of mortgage fraud.

Lower courts blocked the move, citing the “for cause” protections of the Federal Reserve Act. The case now tests presidential reach over Fed independence… and traders will be watching closely.

With no October data, internal dissent, and a legal overhang, the Fed enters December’s meeting flying on instruments — in a storm.

THE WORLD TAPE

London’s flying on instruments... in a storm.

Another leadership implosion, another day of gilt yields jumping and the pound sliding.

For U.S. investors, it’s déjà vu of 2022’s mini-budget mess, and a reminder that even America’s “closest ally” can wobble like an emerging market when politics go feral. The dollar’s quietly loving it.

Across the Atlantic, the “special relationship” isn’t looking so special. U.S. officials reportedly froze a key intelligence-sharing channel with London after leaks tied to the chaos in Westminster.

Expect security briefings to be tense, and the pound to keep feeling it.

Meanwhile, Trump’s pulling another handbrake turn, this time on immigration.

After years of railing against tech visas, he now says he’ll expand H-1B access for “the best and brightest.” Silicon Valley’s execs cheered, but markets are treating it like another Trump beta test: big headline, light follow-through.

And in Beijing, a handshake that traders actually like. China and the U.S. inked a deal to curb the export of fentanyl precursors, a move that doubles as a diplomatic icebreaker.

It’s less about drugs than signaling: Washington and Beijing are back on speaking terms. The yuan caught a bid.

The administration’s “America first” diplomacy keeps generating headline risk, not contagion yet, but traders are watching the spread.

From Our Partners

Inside the A.I. That Trades Like a Human, Only Faster!

Born from breakthroughs in machine learning, this system trained itself on millions of price patterns until it could read the market like a seasoned pro.

Each session makes it sharper, faster, and more confident.

FEDERAL FOCUS

Capitol Hill is set to slam the door on the record-long 43-day shutdown tonight, as the House preps a late vote to fund the government through Jan. 30.

The stopgap bill reverses Trump-era layoffs and blocks future cuts, but a buried clause offering potential $500K payouts to GOP senators sparked cross-aisle outrage. Markets shrugged, reopening matters more than who gets the back pay.

At the White House podium, press secretary Karoline Leavitt dropped a bomb of her own, saying October jobs and inflation data “will likely never be released.”

That admission blindsided economists counting on post-shutdown numbers to guide Fed policy, leaving traders to price the cycle without the usual macro compass.

Meanwhile, D.C. politics turned tabloid again as House Democrats released Epstein-era emails referencing Trump and Ghislaine Maxwell, reigniting the moral-hazard side of the Beltway tape just as the government reopens.

Republicans blasted the move as “click-bait,” while the administration labeled it another “Epstein hoax.”

Washington’s back in session, but it’s bringing chaos with it: fiscal scars, data gaps, and an election-year energy fight still simmering under the floorboards.

U.S. MARKETS CLOSE

From Our Partners

44 Years of Experience. 1 Stock Pick Per Week.

After 7 bear markets, 8 bull runs, and more than four decades of investing, I’ve refined a proven 4-step process for finding 100% stock winners.

Now, as Editor in Chief at WallStreetZen, I’m revealing my latest top pick in this week’s Stock of the Week.

If you want disciplined, data-driven stock ideas — not hype — this is where to start.

CLOSING CALL

Wall Street closed the midweek session with the kind of relief rally only Washington gridlock can deliver.

The Dow punched through and traders finally priced in the end of the 43-day shutdown saga. Under the surface, though, the tape still looked fractured: tech flinched, oil tanked, and everyone’s waiting for real data to come back online.

The Fed remains center stage, cornered between an economy that’s slowing and an inflation story that refuses to die.

The Supreme Court’s upcoming showdown over Lisa Cook’s seat just adds another twist to the “independent-ish” central bank narrative.

Overseas, geopolitical noise hit a full hum… from Trump’s plea for a Netanyahu pardon to a South Africa spat and El Salvador torture allegations that rattled human-rights desks more than bond markets.

Domestically, Congress is back on the job, and D.C. drama is instantly back to full volume.

The shutdown trade may be fading, but volatility’s next act is already warming up — a December Fed pivot, a political knife fight, and an earnings pileup that could rewire sentiment before the weekend.

Tomorrow’s open should be loud.