TQ Evening Briefing

New records printed, but conviction stayed contained. Capital remained exposed while tightening its grip.

MARKET STATE

Records Without Belief

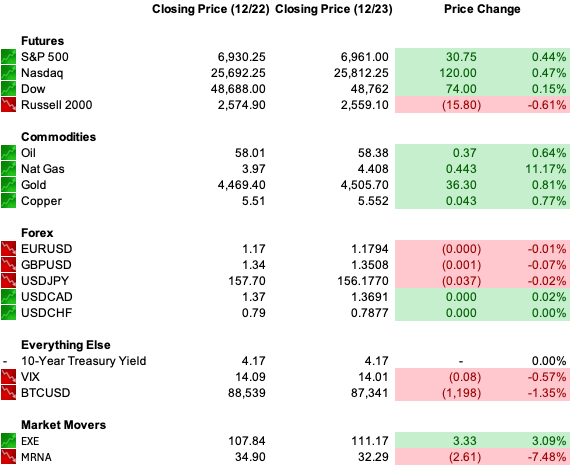

U.S. equities closed the afternoon at fresh record highs, extending the grind higher into a holiday-thinned tape.

Volatility compressed again. Leadership stayed narrow. The surface looked calm.

But the session did not behave like a market discovering new confidence.

Small caps sold off while large caps advanced, widening the participation gap. Breadth deteriorated as the day progressed, even as the indices held green. Volume never followed through.

A 4.3 percent GDP print would normally invite expansion. Instead, it triggered a brief rates adjustment that equities had to digest before stabilizing. The reaction was measured. Almost indifferent.

Capital stayed invested.

It did not add.

The clearest conviction today did not come from equities. It came from metals, where follow-through remained clean and directional even as stocks stalled.

When new highs arrive without participation and insurance assets lead quietly alongside risk, markets are not celebrating growth. They are managing exposure.

This was not a breakout session.

It was a controlled one.

Premier Feature

President Trump just signed a new law…

That could unlock $21 trillion for everyday folks like you…

And potentially impact every checking and savings account in America.

Click here now because Chase, Bank of America, Citigroup, Wells Fargo, and U.S. Bancorp…

Are already preparing for what could be the biggest change to our financial system in 54 years.

WHAT’S ACTUALLY MOVING MARKETS

Liquidity Discipline Is Shaping Behavior

The dominant force today was not growth, inflation, or policy guidance. It was liquidity discipline.

As year-end approaches, participation is narrowing and risk budgets are tightening. That environment changes how capital reacts to information. Strong data does not invite aggressive repositioning, and weak data does not force liquidation.

Repositioning now carries more friction than reward.

Early closes and thin depth compress decision windows, encouraging investors to maintain exposure rather than adjust it. This is not confusion. It is constraint.

Markets are deferring judgment until liquidity improves.

That posture showed up across assets.

Metals Confirmed What Equities Wouldn’t

Equities did not sell off to fund these moves. Volatility did not spike. That sequencing matters.

When protection assets lead while risk holds, capital is not reacting to fear. It is preparing for uncertainty. Hedging is being layered into portfolios that remain exposed elsewhere.

This is not tactical hedging.

It is structural behavior.

Metals are not being traded as momentum expressions. They are being treated as balance-sheet insurance.

Strong Data Failed to Force Repricing

It didn’t.

Rates moved briefly, then stabilized. Equities absorbed the data without urgency. Positioning did not expand.

That tells you how the report was treated. It was backward-looking confirmation, not forward guidance.

This market is not trading growth surprises.

It is trading permission.

And permission remains conditional.

From Our Partners

Bitcoin Is Running Out—and the Smart Money Knows What Comes Next

For the first time in nearly 7 years, less than 15% of all Bitcoin remains on exchanges. At the same time, institutions are buying faster than new BTC can be mined. ETFs, corporations, and governments are creating a real supply shock.

When demand overwhelms supply, price has only one direction to go. This isn’t hype—it’s math. And the next major crypto move may already be setting up.

That’s why 27 top crypto experts are revealing how they’re positioning ahead of this shift.

For a limited time, you can attend FREE.

TAPE & FLOW

The tape moved higher, but the flow underneath stayed restrained.

Index gains came without expansion in participation, and leadership remained tightly clustered in familiar, highly liquid names. Small caps continued to sit out the move. This was not accumulation.

It was position upkeep.

Rates reinforced that interpretation. Yields lifted briefly, then settled without disturbing equities or signaling funding stress. There was no scramble out of duration and no disorderly repricing.

The bond market absorbed pressure and moved on, a sign that real money was adjusting exposure rather than reacting emotionally.

Currencies added another layer of confirmation. The dollar softened even as U.S. data surprised to the upside, while the yen firmed on credibility signals from Tokyo rather than rate expectations alone.

That distinction matters.

When currencies move on governance signals instead of yield math, policy credibility is being priced.

Commodities were where intent showed up most clearly. Metals extended with conviction even as equities held firm. Energy remained subdued, responding to access and enforcement considerations rather than demand forecasts.

Volatility stayed compressed, but not abandoned. Implied levels remained low while protection continued to trade.

Across assets, the message was consistent.

Capital stayed invested.

It did not reach.

POWER & POLICY

Governance Risk Is Moving Into Price

Policy risk is no longer an abstract backdrop. It is actively shaping market structure.

The central question today was not where rates go next, but who ultimately controls the decision-making process.

Public pressure on monetary policy is becoming more explicit, and the Fed chair succession conversation has moved out of the background. When potential successors argue for easier policy alongside strong growth, the framing changes.

Rates stop being purely a tool of restraint.

They become a tool of optics.

Markets respond to that shift quickly.

Internal dissents inside the Fed add duration to the risk. Disagreement is not new, but visibility is. When consensus weakens in public, the confidence premium embedded in policy guidance erodes.

That erosion does not clear quickly.

Globally, the same dynamic is playing out through divergence rather than coordination. Japan continues to tighten while signaling readiness to defend its currency. Elsewhere, policy remains reactive. Synchronization has broken down.

This matters less for today’s prices than for capital planning horizons.

Markets can function with friction.

But they price it.

And increasingly, they are demanding compensation not just for economic risk, but for governance risk.

From Our Partners

The Greatest Stock Story Ever?

I had to share this today.

A strange new “wonder material” just shattered two world records — and the company behind it is suddenly partnering with some of the biggest names in tech.

We’re talking Samsung, LG, Lenovo, Dell, Xiaomi… and Nvidia.

Nvidia is already racing to deploy this technology inside its new AI super-factories.

Why the urgency?

Because this breakthrough could become critical to the next phase of AI. And if any tiny stock has the potential to repeat Nvidia’s 35,600% climb, this might be it.

ONE LEVEL DEEPER

When Rates Become a Market Tool

What changed today was not the expected path of rates. It was how rates are being discussed.

Calls for easier policy alongside strong growth reframed expectations around independence. When credibility becomes a variable, markets adjust before decisions are made.

This is not about when cuts arrive.

It is about whether credibility remains the constraint.

That question introduces duration.

Markets are already adapting.

U.S. MARKETS CLOSE

THE CLOSE

This was not a market demanding conviction. It rewarded discipline.

Records printed, but belief did not expand. Risk remains on, yet tightly managed. Leadership stays narrow. Liquidity is thinning. Insurance is being carried deliberately.

This tape does not punish patience.

It punishes overconfidence.

That is how this market wants to be owned.