TQ Evening Briefing

Records keep printing, but the market isn’t celebrating. This is a grind higher driven by discipline, not excitement, with risk staying on under tight control.

MARKET STATE

Records Without Urgency

This tape is making new highs without changing its posture.

That contrast is the signal.

Holiday liquidity has stripped the session down to intent. What’s left is not aggressive risk-taking, but quiet commitment.

Investors are staying long, not adding recklessly.

Exposure is being maintained, not chased.

Participation remains selective. Leadership is familiar. Protection is still present.

That tells you this rally is not running on excitement or FOMO. It’s being carried by discipline.

There is no stress in the system.

There is also no belief surge.

Instead, confidence is being expressed with restraint.

That’s a late-year behavior pattern, and it tends to persist as long as nothing forces a decision.

This is not a market asking for upside.

It’s a market allowing it, carefully.

Premier Feature

4 Stocks Poised to Lead the Year-End Market Rally

After a volatile summer, markets are roaring back.

The S&P 500 just logged its best September in 15 years — and momentum carried through October, pushing stocks to multi-month highs.

Cooling inflation

Strong earnings

And rising bets on more Fed rate cuts

… Are fueling the move.

But this rebound isn’t broad-based — it’s being driven by energy, manufacturing, and defense sectors thriving under new U.S. policy and global supply shifts.

That’s why our analysts just released a brand-new FREE report featuring 4 stocks we believe are best positioned to benefit as these trends accelerate into year-end.

WHAT’S ACTUALLY MOVING MARKETS

Growth Data Gave Permission, Not Acceleration

The 4.3% GDP print cleared doubt without creating urgency.

The reaction was more than the number: a brief hesitation, a policy check, then equities moved higher anyway.

That sequence defines the regime.

Growth is functioning as a stabilizer, not a launchpad.

This market needs confirmation, not surprise.

Risks are being managed with insurance.

As long as growth validates positioning without threatening policy assumptions, upside can persist…

but it will grind, not sprint.

Tech Leadership Remains the Load-Bearing Wall

Large-cap technology carried the tape again.

What stands out is not momentum, but dependency. Leadership remains narrow, liquid, and familiar.

Small caps are spectators, not participants.

That tells you this is still an allocation trade, not a discovery phase.

Capital wants depth, balance-sheet strength, and visibility into earnings durability.

Late in the year, liquidity outranks curiosity.

This structure can hold markets higher, but it also concentrates fragility.

When leadership does all the work, dispersion matters more than direction.

Hedging Demand Hasn’t Left

Gold holding near record levels isn’t an inflation signal.

It’s a credibility signal.

Investors are comfortable owning equities in a resilient economy, but they’re unwilling to trust policy, duration, or currency stability without insurance.

Capital is not de-risking; it’s conditioning exposure.

The market is pricing uncertainty explicitly rather than ignoring it.

That dynamic suppresses volatility in the short term while keeping optionality alive beneath the surface.

From Our Partners

Warning: Is Nvidia about to Crash?

While some analysts think the stock is overvalued or a bubble ready to pop… Nvidia could actually be about to shock the world with this new invention that could be 1,000 times more powerful than AI. If you missed out on Nvidia's 150X boom…

TAPE & FLOW

Holiday conditions have thinned the tape, but they haven’t hollowed it out.

Price action is quieter, not directionless, and relative behavior is doing more work than headlines.

The Dow continues to hold firm, reflecting demand for balance-sheet strength and earnings visibility.

The Nasdaq is advancing, but without urgency.

Momentum exists, but it is controlled.

Small caps remain laggards, reinforcing that this is not a broad risk chase. It’s a preference signal.

Under the surface, capital is flowing toward quality and dividends rather than high-beta expression.

In a market still near records, investors are choosing durability over optionality.

This is what disciplined participation looks like late in the year.

Exposure stays on, but it is filtered through cash flow, liquidity, and downside control.

Rates remain contained, which removes a major source of friction without reigniting easing enthusiasm.

That balance keeps expectations compressed.

Volatility drifting into the low teens reflects surface calm, but also narrow positioning.

When volatility collapses in thin liquidity, catalysts carry more weight, not because the bull case is fragile, but because protection is lighter at the index level.

Commodities are telling a consistent story alongside equities.

Gold and silver are digesting gains, signaling hedging demand rather than panic.

Oil is supported by enforcement dynamics and geopolitical friction, not a demand shock.

Across assets, the message is coherent.

Growth is intact.

Uncertainty isn’t ignored, it’s being priced, deliberately.

POWER & POLICY

Policy risk is no longer an occasional shock the market absorbs and moves past.

It is becoming a standing condition.

On the surface, the macro backdrop remains cooperative.

Inflation is cooling. Growth is holding.

Financial conditions are not tightening in a way that forces repricing.

On paper, the Fed remains supportive.

But the market’s focus is shifting from outcomes to process.

Governance is creeping into the equation.

It is a live variable.

Markets are increasingly sensitive not just to what decisions are made, but how they are made, by whom, and under what constraints.

That distinction matters because credibility risk behaves differently than rate risk.

Rates can be modeled, hedged, and repriced quickly.

Credibility decays slowly and lingers longer.

Once questioned, it embeds itself into term premiums, currency confidence, and hedging behavior.

That helps explain why insurance assets remain bid even as equities print records.

Capital is not reacting by exiting risk.

It is adjusting to fragmentation.

Exposure is being expressed with tighter construction, shorter feedback loops, and more emphasis on resilience.

This is not a directional environment.

It is a dispersive one.

Returns are separating by quality, execution, and trust rather than by macro beta alone.

In that setting, belief matters less than discipline.

Markets are still willing to lean forward, but only with guardrails built in.

From Our Partners

America’s Top Billionaires Quietly Backed This Startup

When billionaires like Jeff Bezos and Bill Gates back an emerging technology, it’s worth paying attention.

That’s exactly what’s happening with a little-known company founded by an ex-Google visionary. Alexander Green calls it “one of the most overlooked opportunities in AI right now” — and he’s even an investor himself.

He’s now sharing the full story, including why early investors are watching closely and why he believes widespread adoption could be just one announcement away.

ONE LEVEL DEEPER

The Santa rally conversation misses the real signal.

Seasonal strength is easy to track and easy to headline.

What matters more is participation. The market continues to drift higher, but leadership has not broadened in a meaningful way.

Concentration remains the defining feature.

That is not a warning sign on its own. It is a condition.

A rally built on narrow leadership and low volatility can persist longer than expected, especially when liquidity is supportive and alternatives remain unattractive.

But it behaves differently.

It advances carefully.

It punishes excess quickly.

It rewards patience and positioning rather than momentum chasing.

Guardrails stay up.

This is not a market asking investors to believe harder.

It is asking them to be precise.

Until participation widens, upside exists, but it comes with constraints, not acceleration.

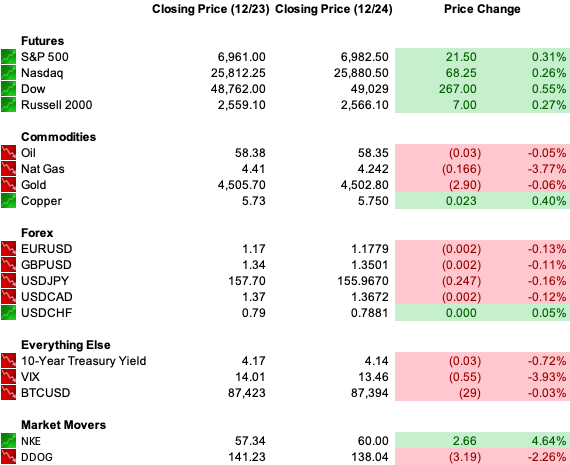

U.S. MARKETS CLOSE

THE CLOSE

This is not a market breaking higher on belief.

It is a market staying invested while actively pricing uncertainty.

Risk remains on, but it is controlled.

Leadership is narrow, familiar, and accepted rather than challenged.

Protection stays in demand even as indexes print records, reflecting confidence without complacency.

Thin liquidity is stripping away noise and exposing intent.

That intent is not aggressive expansion.

It is positioning with guardrails.

As policy paths diverge and credibility questions linger, capital is choosing discipline over enthusiasm.

This is not fear.

It is not euphoria.

It is adaptation.