TQ Evening Briefing

Rates reminded markets who’s in charge. Equities held, AI led, and volatility cleared just in time for the close.

After The Bell

Not a rally, not a retreat. Markets leaned risk-on into the close, but conviction stayed selective.

The yen weakened, and cross-border bond moves quietly tightened financial conditions at the margin.

Leadership tilted back toward tech and AI infrastructure. Elsewhere, the consumer told a different story.

Pressure surfaced where pricing power is thinning and global exposure cuts deeper.

Cyclicals lagged. Transport felt heavier. Housing showed incremental progress, but sentiment refused to follow.

Volatility was never far away.

A historic options expiration injected motion without direction, stretching intraday ranges while leaving the broader structure intact.

The week didn’t end with answers.

It ended with alignment… and a market quietly deciding what it’s willing to carry into year-end.

Premier Feature

America’s Top Billionaires Quietly Backed This Startup

When billionaires like Jeff Bezos and Bill Gates back an emerging technology, it’s worth paying attention.

That’s exactly what’s happening with a little-known company founded by an ex-Google visionary. Alexander Green calls it “one of the most overlooked opportunities in AI right now” — and he’s even an investor himself.

He’s now sharing the full story, including why early investors are watching closely and why he believes widespread adoption could be just one announcement away.

Monetary Pulse

The CPI print cooled, but the Fed wasn’t buying it wholesale.

November inflation slowed, yet officials were quick to flag technical distortions tied to the shutdown.

New York Fed President John Williams put a number on it, suggesting the data likely ran about a tenth too soft.

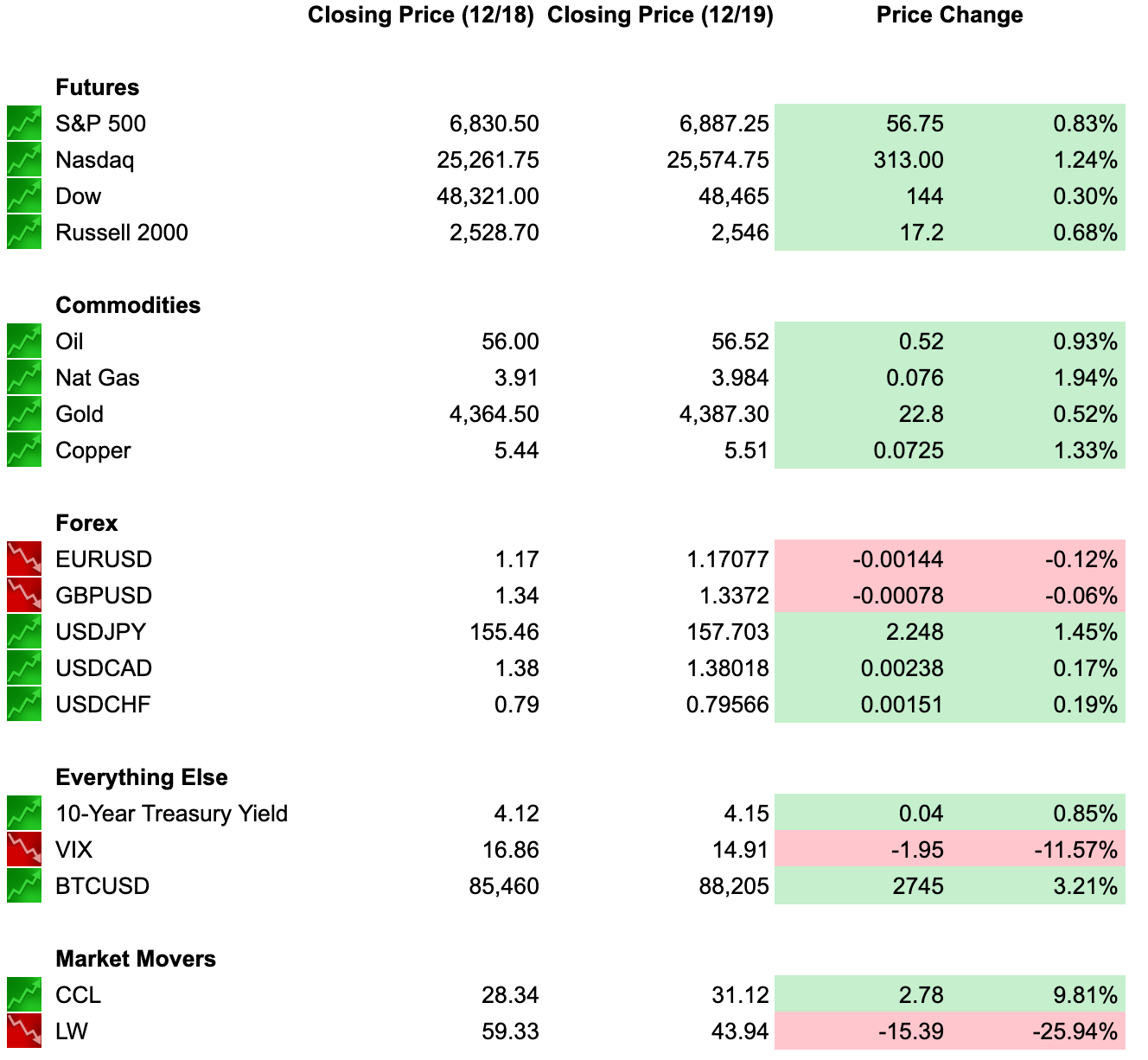

Markets listened. Treasury yields edged higher Friday, with the 10-year back near 4.15%, signaling relief without repricing the policy path.

That caution is shaping expectations inside Washington.

Fed Governor Christopher Waller’s interview for the chair role leaned heavily on labor-market risk rather than inflation victory laps.

With unemployment drifting higher and payroll growth uneven, the emphasis is shifting from fighting prices to managing slowdown optics. Rate cuts are still on the table, but timing remains conditional.

March odds moved up, January stays unlikely.

Globally, the easing cycle is losing momentum.

The Bank of Japan hiked to a 30-year high, the ECB signaled it’s done guiding cuts, and the Bank of England trimmed rates narrowly while warning inflation may stick.

The message across G10 is convergence toward pause, not acceleration.

Threaded together, today favored duration discipline over duration chase.

Long-end yields cap rate-sensitive sectors like housing and utilities, while quality growth and labor-levered cyclicals hold appeal.

Financials benefit from curve stability, and global FX volatility stays selective rather than systemic.

Federal Focus

Washington leaned into optics over nuance, and markets noticed right away where policy might actually land.

The White House moved quickly to suspend the diversity visa lottery after the Brown University shooting.

It’s politically charged, but economically narrow: the program is small, and the signal matters more than the flow. Markets read it as posture, not a shift in workforce dynamics.

Trump, meanwhile, took the CPI print on the road.

Ahead of a North Carolina stop, the president pointed to cooling housing and food prices as proof his economic reset is working, even as approval ratings on the economy remain weak.

The message isn’t new, but the timing matters.

With unemployment drifting higher, the administration is clearly anchoring its narrative to inflation relief... and to voters feeling it before midterms loom.

Policy turned tangible in healthcare.

The White House is set to announce new drug-pricing agreements with major pharma names, extending its push to narrow U.S. prices toward global benchmarks.

Investors are less spooked this time.

Medicaid exposure is limited, discounts are already deep, and prior deals showed margin pressure is manageable rather than existential.

The focus is selective pressure, not sweeping reform. Immigration rhetoric stays headline-heavy.

Healthcare absorbs targeted regulation without breaking.

Consumer-facing and defensive sectors gain clarity, while political noise remains something markets price around, not through.

From Our Partners

WARNING: Do Not Buy AI Stocks

While NVIDIA wobbles and the Magnificent 7 cool off, there's a backdoor AI play most investors are missing.

It's not software. It's not chips.

It’s in the physical infrastructure AI can’t run without — the land, power, and facilities behind every AI data center.

According to former Presidential Advisor Brad Thomas, President Trump’s Executive Orders are about to ignite a massive boom in this overlooked sector.

A small group of companies is positioned to dominate — and most investors have no idea they exist.

Brad names his #1 pick in a short, time-sensitive briefing.

The World Tape

Security commitments are holding, even as politics shift underneath them.

NATO officials signaled cautious optimism that the Czech-led ammunition initiative for Ukraine will continue, despite Prague’s new government questioning funding.

The key detail for markets isn’t Czech politics, it’s continuity.

The program delivers roughly 40% of Kyiv’s artillery supply, and most funding already comes from partners outside Prague, keeping defense logistics intact.

Diplomacy moved back into view.

Ukraine opened a new round of talks with U.S. negotiators, with European allies looped in and parallel discussions expected with Moscow.

No breakthroughs yet, but the presence of draft frameworks on security guarantees and reconstruction signals that negotiations are no longer hypothetical. Markets read this as duration, not resolution.

Elsewhere, Washington leaned into stabilization.

The U.S. has secured pledges for thousands of security personnel to support Haiti’s gang suppression force, exceeding initial targets.

It’s a contained intervention, but one aimed at preventing regional spillover rather than responding after the fact.

Defense contractors and logistics providers retain visibility as commitments persist. Reconstruction-linked materials stay optionality plays, not base cases.

Energy and risk assets remain insulated as geopolitical stress is managed, not escalated, keeping volatility localized rather than systemic.

U.S. Markets Close

From Our Partners

Bitcoin Is Running Out … and the Smart Money Knows What Comes Next

For the first time in nearly 7 years, less than 15% of all Bitcoin remains on exchanges. At the same time, institutions are buying faster than new BTC can be mined. ETFs, corporations, and governments are creating a real supply shock.

When demand overwhelms supply, price has only one direction to go. This isn’t hype—it’s math. And the next major crypto move may already be setting up.

That’s why 27 top crypto experts are revealing how they’re positioning ahead of this shift.

For a limited time, you can attend FREE.

Closing Call

This was a stabilization session, not a breakout.

Global yields firmed, equities absorbed it, and tech reclaimed leadership where demand visibility still exists.

AI wasn’t repriced, it was re-sorted.

Consumer weakness showed up where execution matters most.

With derivatives cleared and macro largely digested, positioning now matters more than narrative.

The tape heads into year-end lighter, tighter, and still selective.