TQ Evening Briefing

This wasn’t a risk-off close. It was risk carried with protection fully engaged.

MARKET STATE

Altitude Holds as Markets Choose Insurance Over Extension

This was a managed-risk close.

Not fear.

Not confidence.

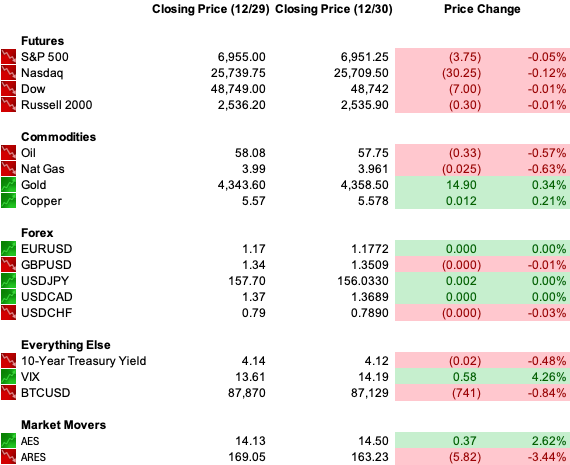

U.S. equities drifted lower into the close for a third straight session, but the tape never destabilized.

Volume stayed light. Volatility never woke up.

This wasn’t sellers taking control.

It was buyers stepping back.

Momentum didn’t reverse, it simply wasn’t invited forward.

At record altitude, permission matters more than enthusiasm.

The louder signals weren’t coming from stocks.

Metals rebounded sharply after leverage was flushed earlier in the week.

The dollar held its broader weakening trend.

Rates stayed pinned, offering no new information and no new tailwind.

Risk remains on.

But it’s conditional.

This is a market protecting prior gains rather than pressing for new ones, a posture that tends to persist as liquidity thins and policy clarity remains unresolved.

Premier Feature

This Crypto Call Could Ruin My Reputation

I’ve never been more nervous to hit “send.”

What I’m about to share could destroy my standing in crypto.

Critics will say I’ve lost it. Some colleagues may walk away.

But I don’t care.

I uncovered something so important about the 2025 crypto market that I stopped everything and wrote a book about it — a roadmap to what I believe could be the biggest wealth opportunity of the decade.

The evidence is so strong, I’m giving the entire book away for free.

If I’m right, this will change how you see crypto forever.

WHAT’S ACTUALLY MOVING MARKETS

Policy Optionality Replaces Policy Impulse

The Fed minutes didn’t move markets, and that’s exactly why they mattered.

Several officials described the decision as finely balanced. Others preferred no cut at all.

Support for further easing was framed as conditional, not directional.

Policy is no longer additive. It’s boxed in by credibility on one side and labor risk on the other.

Cutting too quickly risks inflation trust.

Holding too long risks overshoot.

The Fed is preserving optionality, not steering momentum.

Markets read that cleanly.

Treasury yields barely reacted.

Volatility stayed compressed.

Equities shrugged and kept trading their own structure.

This wasn’t confusion.

It was constraint being priced.

When policy stops providing impulse, markets stop chasing.

They manage exposure instead, and that behavior showed up across assets today.

Metals Reset the Right Way Into Year-End

The rebound in metals wasn’t about changing fundamentals.

It was about clearing mechanics.

Silver led the recovery after Monday’s margin-driven liquidation, with gold, platinum, and copper firming alongside it.

The earlier selloff didn’t break demand.

It broke positioning.

CME margin hikes forced leverage out in thin liquidity.

Today’s follow-through confirmed that once the pressure cleared, price stabilized quickly.

The trade didn’t lose believers.

It lost excess exposure.

That same dynamic is increasingly visible across crowded trades as year-end liquidity tightens.

When rules change, price adjusts, even if conviction doesn’t.

Metals are acting less like inflation trades and more like insurance assets.

They’re being carried alongside risk, not instead of it.

This isn’t panic hedging.

It’s structural preparation.

And in late-cycle conditions, those are the signals that tend to persist longer than expected.

Yuan Strength Signals Control, Not Urgency

China’s onshore yuan held above the seven-per-dollar level, and the lack of reaction mattered more than the level itself.

This wasn’t a disorderly break.

It was tolerated.

Exporters sold dollars into year-end.

And Beijing chose not to aggressively resist the move.

That restraint signals policy intent rather than loss of control.

The message is subtle but important:

China is willing to allow gradual currency strength to support domestic conditions and ease external pressure, especially while global policy paths fragment.

This isn’t stimulus panic.

It’s management.

For markets, that reinforces a broader theme. Currency moves are being governed, not abandoned.

Policy is shaping outcomes quietly rather than reacting loudly.

That kind of control reduces volatility, but it also reinforces a world where growth, liquidity, and capital flows move unevenly.

Markets are adjusting accordingly.

From Our Partners

The Three Key Men Who Could Ignite The Biggest Gold Bull Run in Over 50 Years

According to Dr. David Eifrig, a former Goldman Sachs VP, three powerful men inside the highest levels of the U.S. government are advancing a strange plan that could impact your wealth in a MAJOR way. And in the process, it could spark the biggest gold frenzy in over half a century.

Dr. Eifrig urges you to move your money to his No. 1 gold stock immediately (1,000% upside potential.) He warns if you wait a second longer, you could get priced out.

TAPE & FLOW

Conviction Lives in Protection

The tape stayed calm, but it wasn’t passive.

Large-cap technology drifted lower without cascade.

Communication services outperformed on selective deal activity.

Materials stabilized alongside metals.

Energy held firm despite softer crude, supported by enforcement risk rather than demand optimism.

Breadth told the same story.

Upside participation remained narrow.

This wasn’t broad risk reduction… it was selective trimming.

Capital adjusted exposure without abandoning positions.

Rates reinforced the tone.

The 10-year Treasury stayed anchored near the 4.1–4.2% range.

No growth scare. No easing impulse. Just gravity.

Credit remained calm.

Volatility hovered near year-end lows.

Low VIX without upside acceleration tells you this isn’t complacency. It’s supervision.

Options markets still show demand for protection even as spot volatility stays compressed.

FX remained orderly.

The dollar softened modestly against select majors, enough to support commodities but not enough to signal capital flight.

Across assets, conviction showed up where protection lives, not where momentum breaks out.

Risk stayed on.

Follow-through stayed limited.

Structure did the work.

POWER & POLICY

Credibility Risk Carries Duration

Policy risk is no longer episodic.

It’s becoming structural.

Fed officials continue to emphasize patience, framing decisions around credibility and labor-market risk rather than market comfort.

In another cycle, that would feel stabilizing.

In this one, it doesn’t.

The reason is governance.

The process to select the next Fed chair is no longer background noise.

It’s moving into public positioning.

Markets are increasingly sensitive not just to rate paths, but to how insulated policy decisions will remain from political gravity.

That’s not a rate question. It’s a credibility question.

And credibility risk carries duration.

Globally, policy paths are fragmenting further.

Japan is tightening into a world still pricing future easing. Europe remains cautious.

Synchronization has broken down, and with it the assumption of smooth global liquidity.

Regulatory pressure is also becoming more explicit.

Enforcement actions in energy, margin discipline in derivatives, and growing scrutiny around infrastructure and AI all point to the same shift: permission now matters as much as capital.

Markets can function with friction.

But they price it.

That’s why dispersion is replacing direction, and why protection keeps showing up alongside participation.

From Our Partners

An Investment Once Reserved for the Wealthy Just Opened Up

For decades, this corner of the market was largely inaccessible to everyday investors. Then a recent executive order quietly changed the rules. What was once off-limits is now available in a much more accessible way — and it’s already drawing attention.

ONE LEVEL DEEPER

This Is What Controlled Risk Actually Looks Like

Low volatility doesn’t mean inactivity.

It means rules are working.

Across assets, the pattern is consistent.

Leverage is being capped, policy optionality is being preserved and currency moves are being managed.

This is late-cycle behavior without panic.

At these levels, momentum isn’t self-sustaining. It requires cooperation from liquidity, policy, and structure.

That cooperation is conditional… and markets are adapting to that reality.

Those who respect the lanes stay engaged.

Those who press for extension get rejected quickly.

This environment rewards positioning over prediction.

It punishes excess confidence. And it tends to last longer than expected, especially when nothing breaks.

Quiet markets aren’t asleep.

They’re enforcing discipline.

U.S. MARKETS CLOSE

THE CLOSE

Risk Remains On, But It’s Actively Insured

This wasn’t a market breaking higher on belief.

It was a market staying invested while pricing uncertainty.

Risk remains on, but it’s disciplined.

Leadership is narrow.

Protection is being carried, not abandoned.

As liquidity thins and policy paths continue to diverge, the signal isn’t fear or euphoria.

It’s adaptation.

That restraint tells you how this market wants to be owned right now: exposed, but insured.

Engaged, but selective.

The rally is intact.

But it’s being hedged, deliberately.

And that’s exactly what you want to know heading into the evening.