TQ Evening Briefing

Markets firm up into the weekend as AI stabilizes and tariff headlines swirl, but the data blackout keeps traders flying blind.

AFTER THE BELL

The market closed Friday as indecisively as it traded all week.

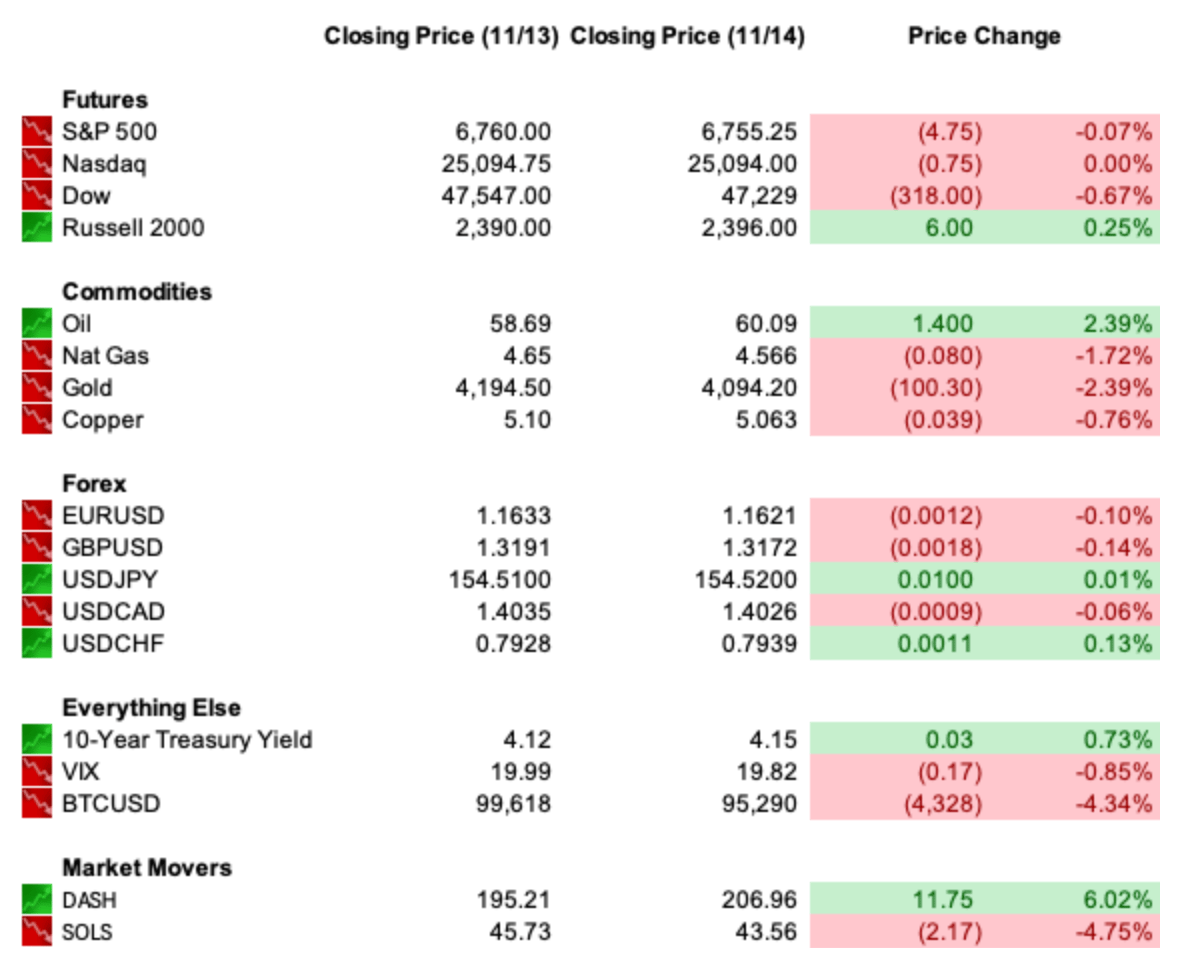

The S&P 500 and the Nasdaq were flat, while the Dow lagged, slipping 0.7%, weighed down by cyclicals after yesterday’s 800-point swing.

The AI complex reclaimed some ground. Nvidia, AMD, Tesla, and Palantir all reversed Thursday’s heavy selling, helping the tech recover part of its 2% drop.

The move wasn’t exuberance, it was recalibration. Traders leaned back into megacap liquidity after valuations took a one-day reset.

Under the surface, the tone stayed volatile.

Concerns over stretched AI multiples, rising debt loads, and cloud-build bottlenecks kept bid-ask spreads wide across semis and hyperscaler-adjacent names. Oracle’s slide earlier in the week still hangs over anything tied to OpenAI spend curves.

Fed expectations added another layer. Odds of a December cut slid toward 43% as sticky-inflation comments from Fed officials collided with the ongoing data blackout.

The shutdown’s end hasn’t clarified the release schedule… if anything, it raised new questions about which reports even exist.

Crypto and global risk stayed soft. Bitcoin fell further below $100K, European equities pulled back, and the VIX bounced around 20.

For the week, the Nasdaq had its second consecutive week in the red, and the S&P 500 and Dow eked out small gains.

Premier Feature

Institutions Are Quietly Buying This “Unsexy” Crypto

Crypto just had its biggest shakeout ever — and while most traders sold in panic, smart money was buying.

One overlooked DeFi protocol is quietly becoming Wall Street’s favorite entry point into decentralized finance.

It’s profitable, revenue-generating, and still trading at a massive discount.

History shows these quiet accumulation phases are where fortunes are made.

Find out why institutions are piling in before retail catches on.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

MONETARY PULSE

Fed commentary stayed divided, but the direction of travel grew clearer.

Mary Daly kept her language neutral, saying she’s “open-minded” on a December cut and views risks across inflation and employment as “balanced.”

Markets heard flexibility, not urgency.

Cleveland’s Beth Hammack reinforced the other side of the ledger.

She argued policy needs to remain “somewhat restrictive” to keep pressure on persistent inflation, noting she doesn’t see enough labor weakness to justify more easing.

Her outlook still places inflation above target for the next two to three years, with tariffs adding stickiness. That aligned with the slide in rate-cut odds.

The data environment remains the biggest constraint.

With the shutdown lifted, agencies haven’t published revised release schedules. September jobs could land next week, but October payrolls will lack an unemployment rate, and October CPI may not be compiled at all.

Democratic lawmakers are pressing for clarity, warning the delay leaves policymakers operating without critical inputs.

For now, the Fed is preparing for December with partial visibility, which elevates every speaker’s tone as the de facto signal.

THE WORLD TAPE

Switzerland’s tariff saga ended with a clean break. The U.S. cut duties on Swiss exports from 39% to 15%, aligning them with EU levels after a concentrated push from Bern’s corporate elite.

The breakthrough followed an Oval Office visit from executives at Richemont, Mercuria, Partners Group, MKS, and Rolex, who offered a mix of commitments and symbolism.

The charm offensive succeeded where official channels stalled.

For Switzerland, the relief is immediate. Watch, pharma, and equipment exporters had spent months modeling production moves to tariff-friendly neighbors as shipments to the U.S. slipped and growth forecasts fell below 1%.

Neutrality debates even resurfaced as Swiss firms questioned why the EU secured preferential treatment first.

For markets, the takeaway is broader than chocolate and chronographs. The deal signals that Trump’s tariff framework is increasingly transactional, rewarding foreign investment pledges with lower U.S. barriers.

If replicated, it could accelerate a global “investment-for-access” pattern that shifts manufacturing footprints, and potentially redirects capital flows into U.S. industrial and energy hubs.

The Swiss win is narrow, but the playbook it reveals is much larger.

From Our Partners

Buffett, Gates and Bezos Quietly Dumping Stocks—Here's Why

The world's wealthiest individuals are making huge moves with their money.

Warren Buffett just liquidated billions of shares. Bill Gates sold 500,000 shares of Microsoft. Jeff Bezos filed to sell Amazon shares worth $4.8 billion.

What is going on? One multi-millionaire believes they are preparing for a catastrophic event. But not a crash, bank run, or recession. It’s something we haven’t seen in America for more than a century.

FEDERAL FOCUS

Washington’s reopening pushed the focus immediately to the economic calendar… or the lack of one.

Labor and Commerce still haven’t issued updated release dates, and patience is thinning on Capitol Hill. Several Democratic senators sent a formal letter arguing the administration can, and should, release collected data ahead of the Fed’s December meeting.

The White House hasn’t responded, and agencies continue to run accuracy checks before committing to timelines.

Practical constraints remain: October payrolls can be processed, but the survey used to calculate the unemployment rate can’t be recreated.

October CPI faces the same issue, given its reliance on in-person collection. September jobs data appears closest to publication, but the broader backlog leaves markets waiting for clarity.

Elsewhere in the capital, President Trump said he will ask the DOJ to investigate ties between Jeffrey Epstein and figures including Bill Clinton, JPMorgan, Larry Summers, and Reid Hoffman.

The announcement adds political noise but doesn’t alter the policy landscape unless agency resources are diverted.

The immediate priority in Washington is straightforward: restore the flow of economic data and stabilize the information pipeline ahead of December’s Fed meeting.

U.S. MARKETS CLOSE

From Our Partners

When a U.S. ally tried to tax ONE American energy company...

Trump didn't hesitate to issue a direct warning.

Now this same company is generating over $3 billion in operating income...

And partnering with the hottest AI stock on Wall Street.

Out of 23,281 publicly traded stocks, this is the ONLY one that meets all the "unicorn" criteria.

CLOSING CALL

Friday closed with a market trying to find its footing rather than chase direction.

Tech stabilized, defences held, and the tape behaved like positioning cleanup into the weekend instead of a fresh trend.

The rotation that defined the week, AI excess deflating while value names carried the load , didn’t break. It just cooled.

With futures pricing for December drifting, and data releases still unscheduled, traders are heading into next week without the macro anchor they were expecting post-shutdown.

Switzerland’s tariff deal tightened FX flows, coffee futures slipped on Latin American tariff cuts, and rates held near 4.15%... small signals, but all pointing to the same theme: the market is trading clarity, not headlines.

Next week will hinge on the data calendar.

If it finally arrives.