TQ Evening Briefing

Markets closed the week under pressure, but the structure remained intact. Risk assets traded lower again, yet the decline lacked the characteristics of forced reduction.

MARKET STATE

The Tape Stayed Open. The Terms Changed.

Markets closed the week under pressure, but the structure remained intact.

Risk assets traded lower again, yet the decline lacked the characteristics of forced reduction.

Volatility rose, but not in a way that destabilized positioning.

The unresolved question from the prior letter was whether the earlier software-led drawdown would propagate into broader balance-sheet stress.

Today’s session answered that narrowly.

Selling pressure remained selective and situational.

Losses accelerated where assumptions depended on extended timelines or fragile durability, while capital continued to circulate elsewhere.

This was continuation of a filtration process rather than escalation.

Rates reinforced the same interpretation.

Treasury yields moved lower as labor data softened, but the curve stayed orderly.

The move reflected growth sensitivity being repriced at the margin, not a collapse in confidence.

Volatility expressed uncertainty without triggering defensive reflexes.

What changed today was tolerance.

The market continued to function, but it shortened the window it is willing to carry unresolved risk.

That shift matters because it reframes pullbacks as tests of structure rather than direction.

Trade Implication

When declines occur without credit or funding stress, assume review rather than rejection. Risk remains viable, but positions must clear faster.

Premier Feature

Fast Movers or Steady Earners? Nuclear Has Both

Not every investor wants the same thing from nuclear stocks.

Some want high-growth momentum tied to uranium prices.

Others prefer steadier revenue backed by long-term contracts and infrastructure spending.

Our analysts took a balanced approach in a FREE report — pairing both in one list.

7 Top Nuclear Stocks to Buy Now highlights companies positioned to benefit as nuclear demand accelerates into 2026 and beyond.

WHAT’S ACTUALLY MOVING MARKETS

AI Acceleration Collided With Execution Reality

The primary driver remained the same, but its character sharpened.

Once replacement becomes plausible, markets compress valuation before earnings respond.

That dynamic continued today.

This was not about missed results or slowing demand.

It was about uncertainty around durability.

Capital reduced exposure where future relevance could no longer be assumed, even if near-term performance remained intact.

The sequencing matters.

Valuation adjustment precedes fundamental deterioration in this phase.

That mechanism altered the operating environment.

Assets tied to long-lived revenue assumptions faced faster scrutiny.

Those with clearer competitive defense or shorter feedback loops retained sponsorship.

Execution Bias

When credibility erodes, pricing moves first. Treat valuation compression ahead of earnings as an early-stage signal, not an overreaction.

Capital Intensity Became a Constraint, Not a Confirmation

A second force came from how markets treated scale.

Large investment commitments no longer functioned as validation by themselves.

Capital continued to believe in long-term opportunity while questioning near-term efficiency.

The focus shifted to timing, sequencing, and secondary effects.

Funding availability remained ample, but the cost of carrying capital-heavy strategies increased.

Returns are now evaluated against rising depreciation, infrastructure strain, and operating leverage that arrives later than spend.

This adjustment did not require policy tightening or liquidity withdrawal.

It emerged organically as investors recalibrated expectations for payoff windows.

Structures that rely on extended buildout phases lost flexibility.

Those able to self-fund or stage investment held up better.

Trade Implication

Scale without visible conversion now carries a higher discount rate. Favor exposures where capital intensity and return timing align.

Mechanical Stress Eased Without Restoring Conviction

The third mechanism was mechanical rather than narrative-driven.

Earlier in the week, pressure in high-beta assets raised the probability of forced selling loops.

Today, those pressures moderated.

Volatility stabilized.

Margin-related flows subsided.

This allowed markets to shift from involuntary deleveraging to discretionary repositioning.

Importantly, this transition occurred without a surge in buying enthusiasm.

Risk was absorbed, not embraced.

This distinction matters.

The reduction in forced selling risk limits near-term downside convexity, but the absence of conviction keeps rallies contained.

The system moved from stress resolution into evaluation.

Execution Bias

As mechanical pressure fades, price action becomes more selective. Expect range-bound behavior unless conviction rebuilds.

From Our Partners

The TRUTH About Trump and Musk?

If you think there's something strange about the "feud" between Trump and Musk…

You need to see THIS jaw-dropping video…

Because it explains what could REALLY be going on behind the scenes…

And how it could hand investors a stake in a $12 trillion revolution.

TAPE & FLOW

Dispersion, Not Liquidation, Did the Work

Flow behavior confirmed the macro read.

Selling pressure remained concentrated in exposures with uncertain durability and long payoff horizons.

The move was global in nature, not confined to a single region or venue.

That consistency reinforced the idea of structural reassessment rather than localized shock.

At the same time, capital continued to rotate toward areas with faster cash conversion and clearer control over inputs.

Activity favored businesses tied to real economic throughput, balance-sheet transparency, and shorter operating cycles.

These flows were steady rather than aggressive, indicating preference rather than urgency.

Breadth narrowed, but participation persisted.

Leadership changed hands frequently.

This was not a momentum tape.

It was a sorting process.

Assets did not need to rally to attract interest; they needed to demonstrate resilience under scrutiny.

Rates trading added texture.

Duration exposure was not abandoned, but it required justification.

Carry strategies no longer enjoyed automatic sponsorship.

Positioning became more sensitive to incremental data and confirmation.

Crypto behavior echoed the mechanical theme.

Price movement reflected liquidation relief and positioning resets rather than renewed belief.

Volatility stayed contained within the asset class, suggesting that stress was processed rather than transferred.

Trade Implication

When flows rotate without breadth collapse, stay engaged but selective. Broad exposure works only when paired with rapid reassessment.

POWER & POLICY

Geopolitics Is No Longer Latent. It Is Active and Asymmetric.

Policy and geopolitics did not drive today’s price action, but they altered the risk surface ahead.

Their importance lies in optionality rather than immediate validation.

That combination increases the probability of abrupt outcomes.

Markets have discounted headline risk, yet operational exposure remains elevated.

Energy logistics, insurance pricing, and shipping routes remain sensitive to miscalculation rather than formal escalation.

Investigations and legal reviews expanded the perimeter around media, technology, and platform behavior.

These actions have not translated into near-term repricing, but they increase uncertainty around strategic flexibility.

Markets are not reacting yet; they are adjusting tolerance quietly.

Trade and industrial policy added another layer.

Tariff frameworks and enforcement debates continue to inject friction into global planning.

These factors matter less for daily pricing and more for capital allocation decisions over the next quarters.

The common feature is asymmetry.

These risks do not degrade gradually.

They arrive discontinuously when conditions align.

Edge Setup

Monitor policy and geopolitical developments for transition points where optionality converts into cash-flow impact. That inflection, not the headline, will matter.

From Our Partners

One Overlooked AI Stock May Be at a Pivotal Moment

Every so often, a company enters a rare “wealth window” — a brief period before a breakthrough goes mainstream and early investors stand to benefit.

According to Alex Green, one small-cap stock in an unusual corner of the AI market may be entering that window now.

He’s seen it before.

• Amazon before it redefined retail

• Apple before it reinvented the phone

• Nvidia before it transformed computing

• Netflix before it changed entertainment

In the days ahead, Alex expects an announcement that could drive widespread adoption — potentially fueling an astounding 4,700% run over the next decade.

This could be the stock investors talk about getting in early.

ONE LEVEL DEEPER

AI Capex Is Outrunning Return Visibility

The clearest signal beneath the surface was the market’s treatment of AI investment returns.

Spending commitments remain intact.

Demand indicators support continued deployment.

Revenue growth continues, but margins are absorbing higher depreciation, power costs, and infrastructure intensity.

The gap between spend and payoff widened just enough to alter perception.

Markets are now underwriting AI as a capital allocation challenge rather than a straightforward growth engine.

That reframing explains the dispersion within large operators.

Performance diverged based on efficiency, sequencing, and balance-sheet flexibility rather than headline growth.

Leadership became conditional.

This signal is durable because it speaks to time.

Capital will wait, but only when there is a credible bridge between investment and return.

Trade Implication

Favor AI exposure where cost discipline and return visibility are explicit. Avoid structures that depend on prolonged patience.

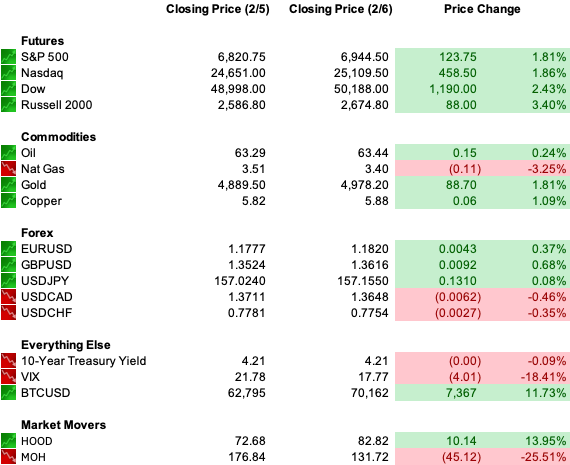

U.S. MARKETS CLOSE

THE CLOSE

The System Is Open. Time Is Not Free.

The session left the market in a narrow corridor.

Liquidity remains available.

Credit continues to function.

Risk has not been withdrawn.

At the same time, tolerance for unresolved assumptions tightened further.

Two paths are open.

Execution improves, costs stabilize, and capital regains comfort carrying longer-duration exposure.

Or constraints persist, forcing continued internal rotation toward assets that resolve faster.

Neither path asserted control today.

The market stayed open, but the clock became louder.

Participation is still rewarded, yet forgiveness has faded.

In this environment, attention to structure matters more than conviction.

When liquidity and skepticism coexist, edge comes from anticipating rotation rather than chasing recovery.