From the T&Q Desk

Good morning. Markets begin the day cautiously higher as investors await details of the White House’s reciprocal tariff policy expected to be unveiled later today. The announcement could help reset the tone for markets, which have been volatile since mid-February as tariff-related uncertainty, sticky inflation, and uneven economic data weighed on sentiment.

Tuesday brought a modest relief rally with the S&P 500 and Nasdaq closing higher, led by gains in consumer discretionary and communication services. Treasuries strengthened, pushing the 10-year yield back below 4.2%, while gold remained near record highs as a haven amid geopolitical and trade-related uncertainty.

Markets are hoping today’s announcement will provide more clarity on whether the administration intends to pursue broad-based tariffs or take a more targeted approach. While the tariff regime is unlikely to be finalized in one day, any insight into timelines, exceptions, or negotiation channels could help stabilize expectations. Beyond tariffs, the focus shifts to this morning’s ADP payrolls report and Friday’s official jobs numbers for a read on the labor market’s strength.

Featured Headlines

Trump's Trade Agenda Creates Winners and Losers

The Trump administration’s tariff regime is reshaping the business landscape, but not all companies are benefitting. While some firms gain from domestic sourcing and reshored manufacturing, many others face rising input costs and logistical challenges. Sectors like autos, semiconductors, and retail are bracing for wide-ranging effects depending on today’s policy specifics.

Read full article →

Tariffs Are Accelerating the Shift of Chinese Factories to Mexico

Facing rising U.S. import costs, Chinese firms are increasingly moving production to Mexico to benefit from USMCA trade rules and avoid tariffs. This trend is reshaping North American supply chains and creating fresh challenges for policymakers and multinational firms alike.

Read full article →

Brazil Caught in the Crossfire of U.S.-China Trade War

As the U.S. and China ramp up retaliatory tariffs, countries like Brazil are struggling to navigate a shifting trade landscape. Once a key exporter to China, Brazil now faces mounting pressure to reorient its economic ties, potentially deepening its relationship with the U.S.

Read full article →

Beyond April 2: Uncertainty Likely to Linger

Even after today’s reciprocal tariff announcement, analysts caution that market volatility may persist. Global responses, potential exemptions, and enforcement questions could keep risk elevated into the second quarter. Investors are urged to remain nimble and diversified.

Read full article →

China Conducts Live-Fire Drills Near Taiwan and East China Sea

Amid rising trade and diplomatic tension, China launched live-fire military exercises near Taiwan and the East China Sea. The drills, announced with minimal notice, signal a sharpening of regional posturing and raise concerns about potential flashpoints in East Asia.

Read full article →

Wall Street Trading Desks Warn of Further S&P 500 Downside

Several major trading desks are cautioning clients that the recent S&P 500 weakness could deepen, especially if today’s tariff plan proves broader than expected. Quant funds and hedge funds have increased hedging activity in recent weeks amid rising volatility.

Read full article →

Previous Trading Day Recap

U.S. stocks finished mostly higher on Tuesday, snapping a multi-session losing streak as investors positioned ahead of today’s long-awaited reciprocal tariff announcement from the White House. The S&P 500 rose 0.3%, the Nasdaq added 0.8%, and the Dow closed flat. Gains were led by growth-oriented sectors including consumer discretionary and communication services, while health care underperformed, dragged lower by weakness in Johnson & Johnson.

Overseas, European equities closed higher after eurozone CPI inflation fell slightly to 2.2% year-over-year in March, a sign of gradually easing price pressure. In Asia, mixed readings were recorded, with the Shanghai Composite rising 0.38% and the Nikkei finishing flat.

On the economic front, U.S. labor market data showed signs of gradual cooling. The February JOLTS report revealed 7.57 million job openings, slightly below expectations, though still exceeding the number of unemployed persons. Meanwhile, ISM Manufacturing PMI slipped back into contraction territory at 49.0, with weakness in new orders and employment components. However, the report’s prices-paid index rose sharply, a potential early signal of supply chain or tariff-related cost pressure.

The bond market rallied on the softer data, pushing the 10-year Treasury yield to 4.19%. Gold held near all-time highs, and crude oil prices fell slightly amid ongoing speculation about the global economic impact of tariffs and potential OPEC+ output adjustments.

Economic Calendar – April 2, 2025

ADP Employment Report (8:15 AM ET)

Factory Orders (10:00 AM ET)

Weekly Crude Oil Inventories (10:30 AM ET)

Earnings Calendar – April 2, 2025

RH (After Market Close)

Overnight Markets

Asia:

Nikkei 225: +0.28%, snapping a three-day losing streak as bargain hunters stepped in following recent weakness in tech and auto names.

Shanghai Composite: flat, with investor sentiment cautious ahead of tariff developments and Chinese trade data due later this week.

Europe (as of 6:00 AM ET):

FTSE 100: -0.72%, as investors digest rising geopolitical tension and brace for potential cross-border tariff retaliation

DAX: -1.00%, with export heavy sectors understandably under pressure.

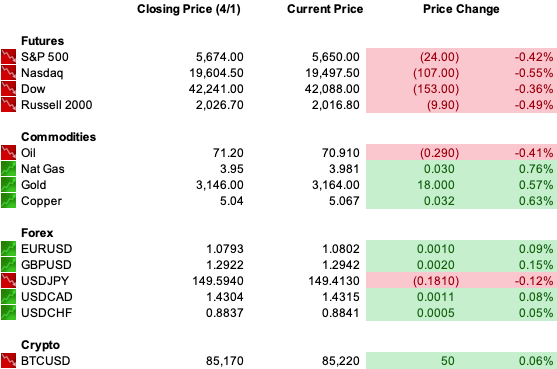

US Pre-Market (As of 6:20 AM ET, April 2, 2025)

Final Thoughts

Today’s tariff announcement marks a key moment for markets. While uncertainty may not vanish overnight, investors are looking for directional clarity to inform outlooks for corporate earnings, inflation, and global trade flows. Keep an eye on sector reactions and bond market movements, which could offer early reads on how Wall Street is interpreting the policy.