T&Q Evening Edition

Fed Fog & The New Geopolitical Tape

The Evening Rewind

Markets fell sharply Thursday as renewed pressure in technology stocks dragged the Nasdaq nearly 2% lower and pulled the S&P 500 down more than 1%. The Dow shed almost 400 points, marking a second decisive risk-off session this week. The slide came amid intensifying valuation worries in AI and tech, with Microsoft extending its losing streak to an eighth straight day and Nvidia joining broader declines. After a six-month melt-up, investors appeared ready to let some air out of stretched multiples.

Economic signals painted a mixed picture. Challenger data showed layoffs at their highest October level in 22 years, countering Wednesday’s resilient private payrolls print and reinforcing the sense of an uneven job market. Meanwhile, tariff uncertainty added to the caution after the Supreme Court signaled skepticism toward the Trump administration’s use of emergency powers for trade duties.

The government shutdown, now the longest in U.S. history, deepened its economic footprint as the FAA announced a 10% flight reduction across 40 major airports, the first tangible hit to consumers and travel. Treasury yields eased to just above 4.09%, the dollar softened, and oil slipped under $60. Gold steadied near $3,990 as investors sought calm in hard assets, while crypto extended its decline even as JPMorgan raised its long-term Bitcoin target.

For a market still running on partial data, every headline feels like a trigger. Thursday’s pullback was a reminder that even the strongest rallies need to breathe before they can climb again.

From Our Partners

One Stock Poised to Soar.

After 7 bear markets, 8 bull runs, and 44 years of firsthand experience, I’ve learned what separates short-term noise from real opportunity.

Now, as Editor in Chief at WallStreetZen, I’m applying a proven 4-step system to pinpoint stocks with the potential for triple-digit gains — and one just rose to the top of my list.

This week’s “Stock of the Week” has the setup I’ve seen before every major winner I’ve ever owned: strong fundamentals, powerful catalysts, and technical confirmation.

My new pick just went live — and early positioning is key.

Your Evening Read

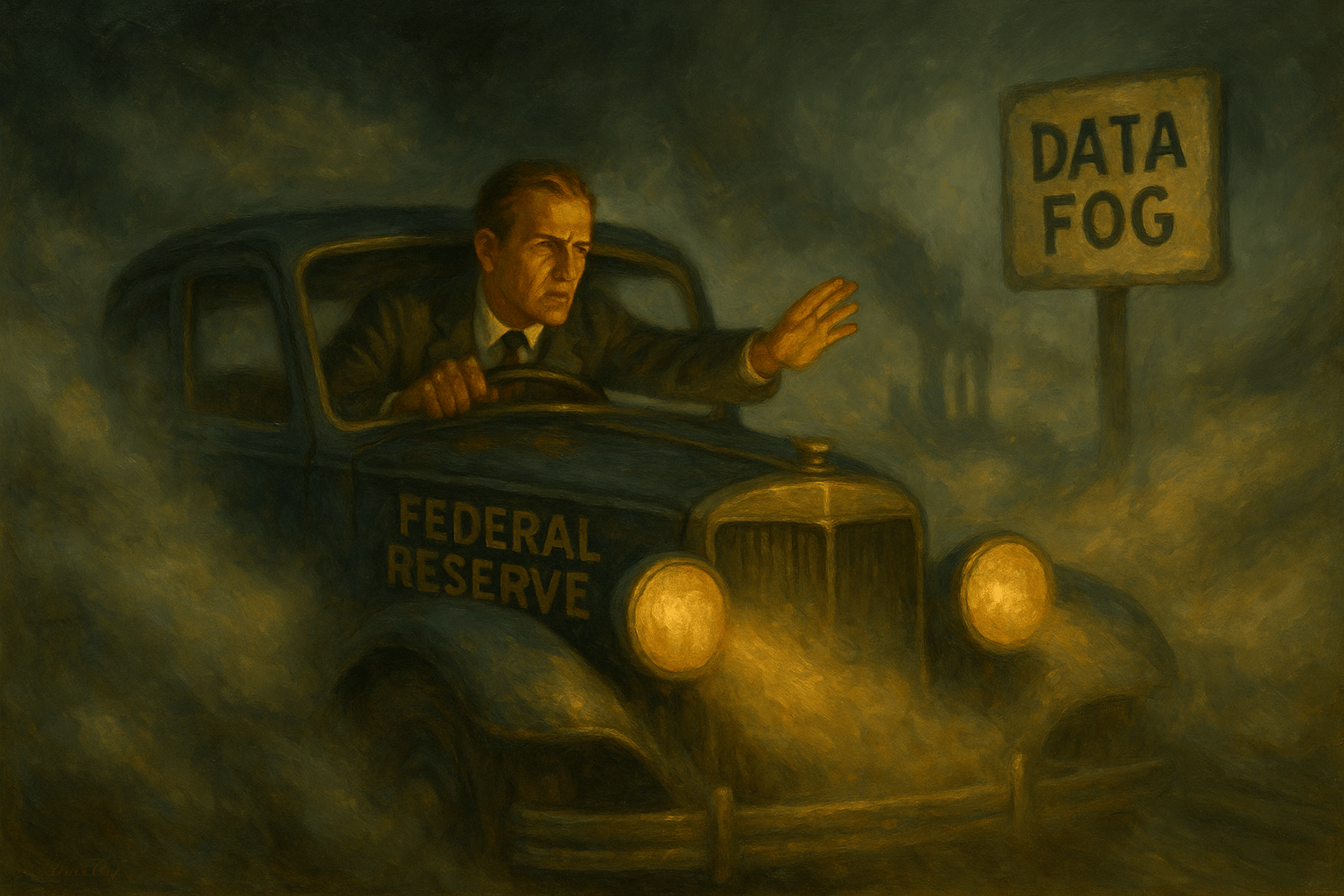

Fed Policy Is Not Broken, It’s Driving Through Dense Data Fog

Speaking of the aforementioned fog…. In its latest “Macro Signposts” piece, PIMCO examines what happens when a central bank must steer the economy without a reliable dashboard. With the U.S. government shutdown eviscerating key macro releases, the Federal Reserve now faces higher thresholds for easing, says economist Tiffany Wilding. Instead of a clear cut-and-dry roadmap, policymakers are operating in “fog,” increasing the odds that the next rate move comes in January, not December.

Wilding’s analysis points to three intersecting pressures: first, labor-market slack that must deepen before the Fed feels confident cutting; second, drifting productivity that slows growth and complicates inflation assumptions; and third, tariff and immigration policies that further obscure the baseline. Together, they create a scenario where staying on the sidelines may be as much a decision as taking action. If you’re waiting for data clarity, you may wait too long… as Wilding writes, “When you’re driving in the fog, you slow down.”

For traders, the key takeaway is one step removed from the usual earnings or inflation watchlist. The real monitor is uncertainty itself. With less data to anchor markets, expect the reaction to surprises — good or bad — to be stronger. When a company issues disappointing guidance or consumer data comes in weak, the move won’t be gradual. The edge will come from managing positioning around shock-risk, not just trend-risk. Wide stops, active hedging and keeping conviction sizes moderate make sense in this climate.

Podcast Highlight

Does Anyone Remember PMIs? Global Statecraft Eclipses Headline Economics

On this episode of MacroVoice, strategist Michael Every walks through how the once-dominant economic gauges like PMIs have been overshadowed by what he calls “political plumbing”... things like sanctions wars, rare-earth embargoes, and currency blocs. With macro-data fading under the shadow of statecraft and strategic competition, Every argues markets must now read geopolitical signals with the same intensity they once lent to ISM prints and flash PMIs.

He outlines a world where the U.S. and China aren’t just trading goods, they’re trading currency settlement systems, mineral access, and alliance structures. Traditional economic models still matter, but today they may lag the more vivid signals of global economic realignment. For instance, Every points to the recent rare-earth export controls by China and corresponding clauses in U.S. defence contracts as the type of catalyst now likely to impact markets more than a 52.4 services PMI reading.

For traders, the message is clear: Information is now more latent, leadership may be less about earnings beats and more about alliance outcomes, and surprises will come not only from data prints but treaty announcements, export-block decisions, or ledger revisions. If you’re still leaning on macro-charts alone, you may be late. Today’s edge could lie in monitoring ships, pipelines, and press releases before earnings summaries.

From Our Partners

The Man Who Predicted the iPhone 17 Years Early Speaks Out

George Gilder's track record is legendary. He gave Steve Jobs the iPhone idea in 1990. He foresaw Qualcomm’s rise BEFORE it soared 2,600% in one year.

Both sounded ludicrous at the time, but there’s a reason he’s been called “America’s #1 Futurist.”

Now he believes a rare "super convergence" event will create more millionaires in the next few years than we've seen in decades.

A bombshell announcement scheduled just days from now could trigger it all.

Closing Call

With traders digesting a bruising session that saw tech lead markets lower and breadth deteriorate sharply, the tape looks less interested in stability than in shaking out exuberance, a recalibration that’s uncomfortable but overdue.

Heading into Friday, two wires will tug at positioning: the earnings calendar broadens with names in energy, consumer and utilities stepping into the spotlight, and the missing government data loom larger than ever. Private-sector surveys and company releases are all that remain. In an environment where the lack of data is itself data, the next move may come not from a headline but from which companies hold up and which don’t. If earnings beat broadly, risk assets get permission to rebuild. If not, the market may treat last week’s highs as resistance rather than a stepping stone.