T&Q Evening Edition

On Political Trading & Philosophical Investing

The Evening Rewind

Friday wrapped with a calm exhale rather than a rally. After a seesaw week, the Dow inched up 0.16%, while the S&P 500 and Nasdaq split directions… modest gains in value and industrial names to offset another dip in high-growth tech. The tone was distinctly defensive: investors took profits in megacaps and rotated toward gold and energy, which both firmed into the close.

The day’s data didn’t clear the fog much. Headlines on rising layoffs and shutdown-distorted sentiment (like University of Michigan’s Consumer Sentiment Index being near all-time lows) reinforced the idea that soft-landing optimism is wearing thin. The morning’s “wait-and-see” call proved right: no breakout, just quiet repositioning before the weekend. Treasury yields hovered near their weekly lows, and the dollar’s edge suggested traders were squaring books rather than chasing risk. Gold and crude both inched up slightly too.

Markets ended the week still digesting the post-AI comedown and the absence of fresh macro clues. Friday’s action summed it up neatly: risk appetite isn’t gone, but it’s taking a long lunch.

From Our Partners

4 Stocks Poised to Lead the Year-End Market Rally

The S&P 500 just logged its best September in 15 years — and momentum carried through October, pushing stocks to multi-month highs.

Cooling inflation, strong earnings, and rising bets on more Fed rate cuts are fueling the move.

But this rebound isn’t broad-based — it’s being driven by energy, manufacturing, and defense sectors thriving under new U.S. policy and global supply shifts.

That’s why our analysts just released a brand-new FREE report featuring 4 stocks we believe are best positioned to benefit as these trends accelerate into year-end.

Your Evening Read

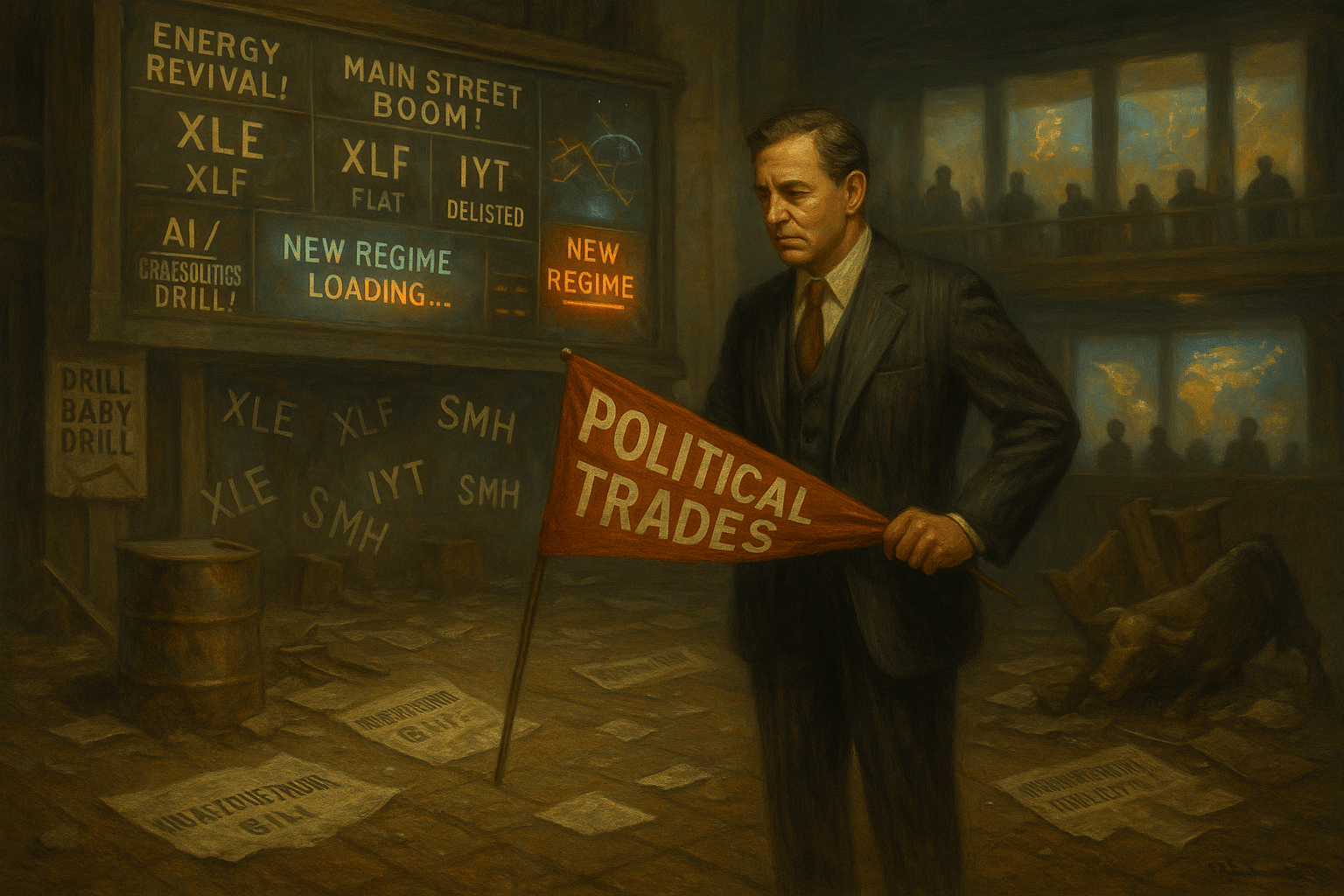

Which Trump Trades Actually Paid Off… And Which Ones Face-Planted?

Morningstar’s latest post does what every trader secretly loves: scorekeeping. It revisits the big “Trump trades” from the 2017-2020 boom years and asks who really cashed in once the political fireworks faded. The short version? Tax-cut darlings like cyclicals and small caps did fine, until gravity and valuations teamed up. Infrastructure stocks, however, spent years waiting for shovels that never hit dirt, while the much-hyped “repatriation windfall” turned out to be more of a Wall Street transfer than a Main Street revival.

The fun part is the flops. Energy’s “drill baby drill” revival mostly fizzled in a world drowning in crude. Bank deregulation never juiced lending the way headline writers promised. Even health-care dereg bets flatlined once markets realized deregulating health care is about as simple as herding drug-price committees.

The kicker: Morningstar says traders still chasing those ghosts are playing last decade’s game. With new policy fog and the AI-geopolitics-re-shoring trifecta taking over, the real money now hides in the trades no one’s tweeting about yet. In other words, you might wanna reconsider big bets on MAGA stocks…. It's time to Make Allocation Great Again.

Podcast Highlight

What The World’s Great Philosophers Can Still Teach Us About Wealth And Wisdom

In this thoughtful episode of The Investor’s Podcast, Kyle Grieve takes the mic and leads a deep dive into how ideas from Aristotle, Seneca, and more ancient thinkers still apply to modern investing. He argues that the stock market might look like spreadsheets and charts, but the real game is ancient: mastering emotion, dealing with uncertainty, and knowing when to hold and when to fold.

Grieve frames wealth not just as a number on a screen, but as a state of character. Drawing on Stoic wisdom, he discusses how controlling your reaction to outcomes matters more than trying to predict them. The parallels to trading are obvious: you’ll never nail every earnings beat or rate cut, but you can choose how you respond when the tape goes rogue.

For traders eyeing short-term cycles and long-term trajectories alike, the takeaway is clear: philosophy isn’t just background noise, it’s risk-management by mindset. With macro flows getting shifty and valuations reaching for the moon, this episode reminds us that sometimes the best hedge isn’t a derivative… it's discipline.

From Our Partners

10 Stocks for Income and Triple-Digit Potential

Why choose between growth or income when you can have both?

Our new report reveals 10 “Double Engine” stocks — companies built for rising dividends and breakout price gains.

Each has the scale, cash flow, and catalysts to outperform as markets rotate after the Fed’s pivot.

These are portfolio workhorses — reliable payouts today, compounding gains tomorrow.

Closing Call

Next week starts with a low-vol simmer rather than a bang. Monday is mostly plumbing, with a cluster of Treasury bill and note auctions plus the USDA’s WASDE report and wholesale inventory updates that will give macro desks a feel for funding costs and supply chain tone. Veterans Day on Tuesday keeps the stock market open but shuts the bond market, which usually means thinner liquidity and a higher chance that any surprise headline produces an exaggerated move rather than a clean signal.

The real tension sits in the back half of the week. On the official calendar, Thursday and Friday bring the October inflation block, CPI then PPI, along with retail sales, all of which would normally be must-watch releases… BUT with the shutdown still snarling federal data, there is a real risk those prints slip, which only magnifies the importance of private surveys, corporate guidance and any stray Fed remarks

Earnings season shifts to a more idiosyncratic mix, from names like Monday.com and Barrick to energy and materials producers that double as macro tells. Bottom line for traders heading into the weekend: next week is not about a single binary event, it is about whether a data starved market finally gets new information on inflation and the consumer or has to keep trading the fog. Size your risk like the numbers might land, but keep your playbook ready for another week of guessing.