T&Q Evening Edition

Broker Bubbles & Internet Re-Wires

The Evening Rewind

Today… a collective exhale. The S&P 500 rose approximately 1.5%, the Nasdaq Composite jumped over 2%, and even the Dow edged up nearly 0.8%. Tech took the lead, gold surged past $4,120 (+2.8%), and crude held near $60… a setting that speaks more of relief than resolve. The uptick followed significant progress on the government shutdown front and a splash of better-than-expected private data, giving traders a reason to believe the margin for surprise had shrunk.

Underneath the surface, this wasn’t the broad-based breakout some hoped for as breadth remains narrow and leadership is still concentrated in tech. The recovery built on momentum rather than fresh conviction: circuit breakers rattled, valuations stretched further, and liquidity remained the silent backbone. The shutdown/data blackout is a key drag, and while today’s move suggests that risk is easing, but not gone.

In short, today’s move was less a turning point and more a “restart button”: the market pressed it, but hasn’t yet fast-forwarded. Positioning tightened, caution remains the default, and signs of durability will have to come next.

From Our Partners

Former Illinois Farmboy Built a Weird A.I. System to Expose His Wife's Killer...

After his wife's untimely death, he used Artificial Intelligence to get sweet revenge...

But what happened next could change everything... while making a select few early investors very rich.

Your Evening Read

When Brokers Go To The Moon It’s Rarely Just About Better Trading Apps

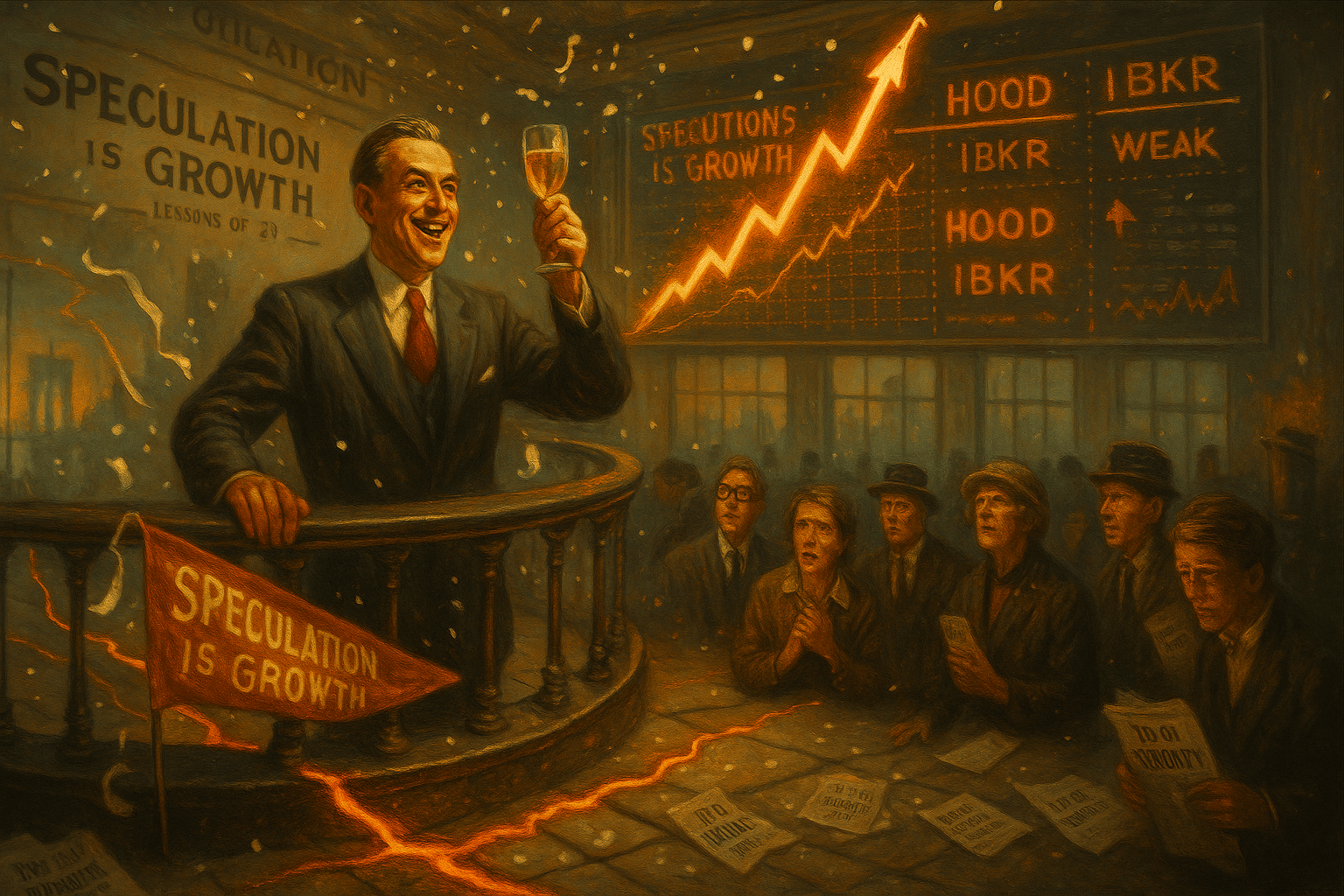

In this piece from Acadian Asset Management, Dr. Owen Lamont shows us one of the lesser-watched hallmarks of speculative bubbles: booming broker stocks. He maps how during historical bubbles (from the Mississippi Bubble to Japan’s 1980s high tech boom) securities firms surged while speculation went wild. Today’s brokers, he says, are flashing a yellow alert: names such as Robinhood Markets and Interactive Brokers Group have exploded in value, echoing excesses of past market froth.

The crux of Lamont’s argument is simple: when the guys selling you the tools of speculation are winning big, ask whether the trade is smart or simply dialled up on volume. He notes that record issuance, IPOs of brokerages, and heightened trading commissions have historically preceded corrections. He doesn’t say we’re heading straight into a crash… but he points out that you should notice when brokers are on fire for the same reason they get burnt later.

For traders today, the takeaway is two-fold. First: review how much your portfolio depends on “more trading” as the catalyst. If you’re hoping for the market to rally because people will just buy more, you might be in the camp Lamont calls “selling picks in a gold rush.” Second: rotate your lens from just sectors and earnings to who profits from the activity itself. The winners may not be the flashy names surfing the wave of AI, but the ones building the bank of flows, commissions and services under the surface.

Podcast Highlight

How Perplexity Wants To Rewire The Internet… And What It Means For Alpha Hunters

In this episode of Odd Lots, Dimitry Shevelenko, co-founder of Perplexity AI, takes us behind the scenes of the company’s ambition to reshape not just search but the entire internet layer. He argues that the future isn’t simply about better Google, it’s about replacing static queries with dynamic agents that respond, reason, and even adapt. Instead of typing questions, Shevelenko suggests, users will engage with “constantly evolving knowledge graphs.”

What’s intriguing from a trading-lens: Perplexity isn’t just a consumer product… it’s staking a claim in infrastructure. Shevelenko explains how they’re engaging with data-providers, cloud vendors, content aggregators, and even niche verticals like legal research and healthcare. This positions them less like a search app and more like a gateway through which large volumes of cloud spend, compute cycles, and enterprise monetization flow. The implication: when an AI company talks infrastructure, it’s not just hype, it’s moving into the “plumbing of tomorrow.”

That’s the key nuance here. It’s no longer enough to pick the next “AI winner”, you must ask whether the company is building a moat, monetizing data-ops, and scaling compute. Perplexity’s vision implies that the next wave of gains may come from service providers, data infrastructure, and enterprise licensing models, not just apps riding the AI theme.

From Our Partners

Trump’s Exec Order #14154… A “Millionaire-Maker”

He’s overcome insane and criminal vote rigging.

And survived every indictment and impeachment thrown at him.

But his next move could make him a legend – and perhaps the most popular president in U.S. History.

Former Presidential Advisor, Jim Rickards says, “Trump is on the verge of accomplishing something no President has ever done before."

And if he’s successful, it could kick off one of the greatest wealth booms in history.

We recently sat down with Rickards to capture all the key details on tape.

Closing Call

Tomorrow is quieter on the data front but still relevant for positioning. The bond market and select bank holiday-closures mean liquidity is likely to be lighter than usual. Economic releases are minimal, the most notable is the NFIB Small Business Optimism Index for October, along with a scheduled speech by Michael Barr of the Federal Reserve. The lack of a data-heavy agenda means markets may focus even more on earnings previews, flow signals, and policy commentary rather than macro surprises.

Because liquidity will be thinner, any earnings standout or Fed-tone comment could move markets more than usual. Traders might treat the day as a holding pattern: scaling exposure modestly if yesterday’s risk uptick holds, or lightening if early weakness hits and confirms tech/capital-spend fatigue. In short: tomorrow is less about big numbers and more about micro-shifts and market mood checks.