TQ Morning Briefing

The market is trying to stabilize after software shock, but the week’s real story is sequencing. AI capex is accelerating, disruption risk is spreading, and reliability is becoming a pricing input across assets.

MARKET STATE

Stabilization Is Not Relief. It Is a Test of Sponsorship.

Futures are mixed as investors attempt to move past the worst of the software flush, but the market is not back to paying for confidence.

It is checking whether the system can absorb a repricing of tech assumptions without forcing a broader unwind.

The major indices look calmer than the internals. The tech complex is still being audited name by name. Software remains fragile because the debate is not about growth. It is about defensibility.

Chips and infrastructure-linked names can hold better when capex guides validate demand, but that comes with a new question. The capex itself is now a risk factor.

Rates remain composed. Credit is functional. Liquidity is present. That is the point.

The market is not exiting risk because the system is still clearing. It is tightening what it will underwrite inside that clearing.

Metals and crypto are reinforcing the same message through different mechanics.

Silver volatility continues to behave like deleveraging and margin tightening. Bitcoin’s slide looks like liquidation pressure and institutional flow reversal rather than a sudden collapse in belief.

Those are not identical signals, but they rhyme. When positioning is crowded and funding is tight, the market will punish weak structures even if the broader system is stable.

The most important question into the open is whether software remains contained as a sector repricing or continues to travel up the stack into sponsors, lenders, and financial intermediaries tied to the same cash flows.

The market does not need panic for contagion. It only needs credibility loss.

Trade Implication

Do not confuse an orderly open with a repaired tape. Invalidation is faster now. Size positions with shorter review cycles.

Premier Feature

$1,000 into $556,454. Impossible?

I want to show you something that might make you upset.

For decades, the biggest banks in America have been using a secret account to collect an average of 29% per year — without ever telling the public.

Since 2000, this single account has turned $1,000 into over $556,454.

Not by picking stocks or timing the market. Just by parking money in an account that’s averaged 29% year after year.

The big banks knew about it. You didn’t.

That changes today.

WHAT ACTUALLY MOVED MARKETS

AI Spend Accelerated While Disruption Risk Spread Wider

The first driver is the collision between acceleration and anxiety inside AI.

But the scale of spending forces the market to price return timelines, depreciation drag, and the second order impact on customers that fund the ecosystem.

The market can believe in the buildout and still reprice the economics of it.

At the same time, AI disruption is no longer a thematic debate.

Tools that can replicate workflows are changing how investors underwrite entire software categories. That is why software has sold off harder than many semis.

The third layer is that constraints are becoming visible across the supply chain.

Memory shortages are pressuring smartphone production expectations, which feeds directly into guidance sensitivity for key chip designers and architecture providers.

That is not an AI story. It is a reminder that real world throughput can override narratives.

Execution Bias

AI remains a dominant capex cycle. The market is now separating builders, beneficiaries, and casualties. Positioning that relies on one bucket will struggle.

TAPE & FLOW

Rotation With a Harder Filter

Flow continues to confirm dispersion.

Selling pressure in software remains deliberate and layered. The shift is no longer limited to one day of shock. It is a reevaluation of durability.

Some bargain hunting is emerging, but the market is not granting the benefit of the doubt without catalysts.

The rest of the tape is behaving differently. Cyclical and cash conversion exposures have held sponsorship because their feedback loops are shorter and their economics are easier to model.

That is the underlying reason the broader market has stayed functional even as tech has been hit.

Precious metals remain unstable. The moves are too sharp to treat as pure macro signals. This is what a positioning unwind looks like when liquidity is tighter and margins rise.

Crypto is echoing that structure, with liquidations driving price action and institutional flows appearing to reverse.

Execution Bias

This is not a one trade market. Leadership is turning faster. Weak assumptions are being punished earlier.

From Our Partners

DO THIS Before Gold Hits $10K

Gold’s recent run-up has been nothing short of historic — and many experts believe it’s far from over.

Some forecasts now point to gold reaching $10,000 an ounce… with one analyst even projecting $20,000.

But no matter how high gold ultimately goes, it’s critical that you know how to position yourself for the next major move.

POWER & POLICY

Governance Is Reentering as an Operating Constraint

Policy is influencing markets through reliability and control.

The administration’s move to make it easier to remove senior federal employees increases perceived execution risk inside agencies.

Markets care less about the politics than the operational implication. When staffing stability becomes conditional, process continuity becomes a variable.

Semis, energy, food, and critical minerals are no longer just supply chains. They are state priorities.

That shifts the global economy toward redundancy and higher structural costs even when tariffs are stable.

Geopolitically, easing rhetoric and persistent friction continue to coexist.

Energy and shipping risk premia can compress on diplomacy headlines while operability costs remain elevated through insurance, routing, compliance, and security.

Trade Implication

Policy should be treated as a standing constraint. Favor exposures that function under friction, not only under smooth execution.

ONE LEVEL DEEPER

Liquidity Engineering Is Becoming Part of the Story

The deeper signal is that the market is no longer assuming time will solve distribution problems.

Investors and issuers are trying to engineer liquidity paths earlier to avoid a single point of selling pressure.

This is not just a tech story. It is a symptom of a market that is shortening patience and demanding earlier sponsorship for size.

Across assets, the cost of delay is being assigned rather than socialized.

In software, it is multiple compression. In AI infrastructure, it is capex scrutiny. In metals and crypto, it is margin and liquidation dynamics. In policy, it is operability risk.

Edge Setup

Favor structures that can absorb delay without refinancing stress. The trigger is slippage without a credible bridge.

MARKET CALENDAR

Economic Data: Weekly initial jobless claims, JOLTS

Earnings: ConocoPhillips, Hershey, Intercontinental Exchange, KKR, Fortinet, Monolithic Power Systems, Amazon after the close

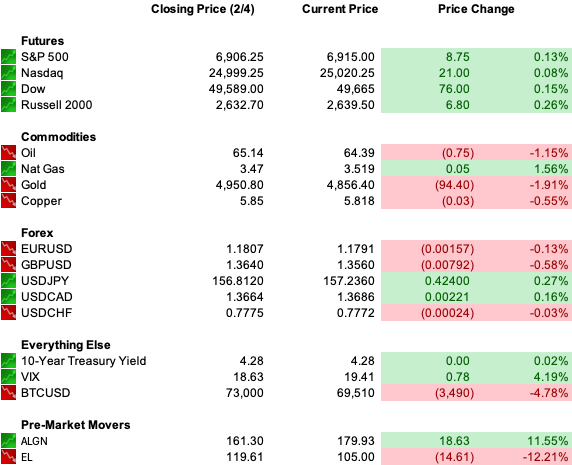

Overnight: Nikkei -0.88%, Shanghai -0.64%, FTSE 100 -0.07%, DAX -0.08%

U.S. PRE-MARKET

From Our Partners

Bitcoin Is Coiling — History Says a Massive Move Is Coming

For weeks, Bitcoin has been trapped in a tight range as volatility collapses to six-month lows.

These compression patterns don’t last. In past cycles, similar squeezes were followed by explosive rallies, with select crypto assets surging thousands of percent.

The biggest gains happen before the breakout becomes obvious, while prices are still quiet and most investors are waiting.

A hedge fund insider has just activated a proven strategy designed specifically for moments like this.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

THE CLOSE

This is not a crash tape. It is an accountability tape.

Liquidity is present. Credit is functional. Indexes can hold together.

But the market is repricing who carries disruption risk, who carries capex burden, and who can defend assumptions quickly.

Stability is not the signal. Sponsorship is.

The system is still open.

The referee is stricter.

The trade is not fear.

The trade is accountability.