TQ Evening Briefing

The tape stayed intact while counterparties got re-rated. Policy pressure moved into earnings, trade slid deeper into regulation, and “U.S. exposure” became something investors actively modeled again.

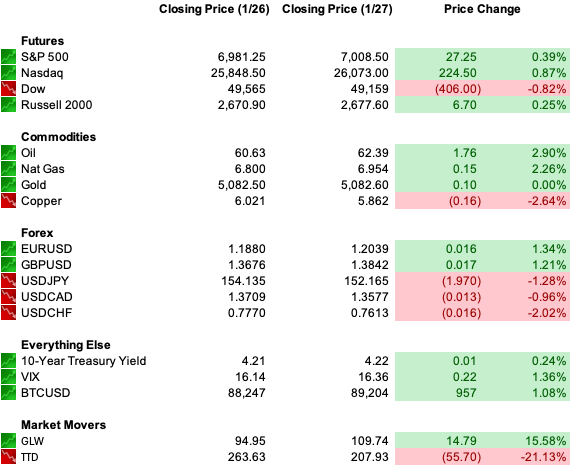

MARKET STATE

A Sorting Tape With Clear Preferences

Health insurers sold off sharply again today as Medicare pricing expectations reset, even as the broader market stayed calm and continued to trade earnings.

The market spent the day making distinctions rather than declarations.

Index action stayed calm.

Volatility drifted lower.

Credit conditions remained orderly.

Capital continued rotating toward businesses with clean pricing power, limited policy exposure, and operational clarity.

This was not about growth confidence fading.

It was about permission becoming explicit.

Investors showed they are willing to own risk, but they want to know who controls the margin, who writes the rules, and who absorbs the shock when policy shifts.

That dynamic explained the divergence across sectors.

You could see stability at the index level while entire groups repriced sharply.

The market wasn’t nervous.

It was deliberate.

Leadership narrowed around businesses that could explain their exposure without relying on external relief.

Everything else carried a wider discount, even if fundamentals looked unchanged.

This is what a strong tape looks like when assumptions tighten.

Risk still trades.

It just trades through filters that were not present a year ago.

Premier Feature

February’s #1 Memecoin Still Trading for Pennies

Memecoins don’t move slowly, they explode.

We’ve seen runs of 600% in a day, 1,100% in 48 hours, and 8,200% in months when momentum hits.

Right now, the market is oversold and fear is high — the exact setup that often precedes powerful January rallies. And when crypto turns higher, memecoins don’t just follow… they lead.

That’s why analysts Brian and Joe just flagged their #1 memecoin for February 2026. It’s still trading at pennies, with viral energy, real utility, and a capped supply with a built-in burn.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

WHAT’S ACTUALLY MOVING MARKETS

Health Care Reintroduced Counterparty Risk In Real Time

The selloff in health insurers wasn’t driven by utilization or demand signals.

It came from a reminder about who ultimately sets the economics.

The administration’s decision to keep Medicare Advantage rate increases flat for 2027 reset expectations quickly.

Investors had priced a more accommodating posture.

What they received instead was clarity around spending discipline and measurement accuracy.

Once margins are tied directly to government calibration, tone matters as much as math.

The market treated the announcement as a repricing of counterparty quality rather than a sector-wide indictment.

That distinction explains the speed and focus of the move.

The Dow lagged while other areas held firm.

This was not macro fear.

It was policy sensitivity being brought forward.

Health care didn’t lose relevance.

It lost certainty.

Trade Pressure Shifted From Tariffs To Jurisdiction

The U.S. message wasn’t framed around duties or quotas.

It focused on regulatory treatment of American technology firms, with Coupang at the center.

That signals where trade friction now lives.

Digital regulation has become a proxy for trade leverage.

Investigations, enforcement standards, and market access rules now function as negotiating tools.

That pulls platform governance into the same arena as autos, energy, and pharmaceuticals.

Markets absorbed the headline without index stress because the impact is company-specific.

Exposure gets repriced at the edges, where regulation and revenue intersect.

This is why trade rarely spikes volatility anymore.

It no longer arrives as a single shock.

It seeps into operating assumptions.

Canada Added Supply Chain Optionality To The Equation

Canada’s posture added another layer to the trade narrative.

Prime Minister Carney’s insistence that his Davos comments were deliberate signaled that USMCA negotiations are already becoming leverage points.

The timing matters, with reviews approaching and trust eroding earlier than expected.

Canada’s decision to allow low-tariff Chinese EV imports intensified the issue.

GM’s response captured the concern clearly.

If Canada becomes a back door for China’s EV supply chain, North American manufacturing alignment weakens.

Markets didn’t react with panic.

They adjusted expectations.

Firms with domestic capacity and compliant sourcing gained relative appeal.

Those relying on cross-border openness faced wider scrutiny.

Trade didn’t disrupt the tape.

It reshaped the opportunity set.

From Our Partners

New Gold Price Target: January 28 Warning

Major investment banks now predict gold could surge past $6,000 an ounce this year, with some analysts even calling for $10,000.

With 2026 shaping up to be a year of growing uncertainty, many expect gold to skyrocket.

But before you rush to buy bullion or gold stocks, there’s something important to know.

Most investors will likely miss the biggest gains because there’s a little-known way to profit from gold that has nothing to do with bullion, ETFs, or mining stocks. In one period alone, this approach reportedly turned $5,000 into more than $1.6 million.

EQUITIES IN FOCUS

Execution And Exposure Defined Leadership

Equity leadership followed the same sorting logic.

Technology remained supported, especially where AI investment could be tied to efficiency, monetization, and control.

Investors showed less interest in raw spend stories and more interest in throughput and pricing leverage.

Logistics and industrial names acted as quiet anchors.

UPS stood out by choosing margin clarity over volume dependence.

The market rewarded the decision to exit lower-quality revenue in exchange for operational leverage.

Automotive names reflected the new trade reality.

GM’s focus on domestic production and tariff planning resonated because it acknowledged friction rather than assuming it away.

Health care moved in the opposite direction.

Insurers saw their multiples compress as policy became the dominant variable in their cash flow model.

Consumer brands delivered mixed signals.

Nike’s distribution layoffs were interpreted as operational tightening, not demand collapse.

That response fits a broader corporate trend toward simplification and automation.

Across sectors, leadership favored companies that could articulate how they operate when rules change and costs move unevenly.

TAPE & FLOW

Capital Deployed With Conditions Attached

Flows confirmed that risk appetite remains intact.

Liquidity stayed healthy.

Credit spreads remained controlled.

Volatility eased without forcing a chase.

These conditions allowed equity markets to hold together even as sector dispersion widened.

Capital gravitated toward businesses that could operate cleanly under policy friction.

Infrastructure, logistics, and energy exposure continued to attract steady allocation.

Duration stayed sensitive, reflecting the political component embedded in term premium.

It’s expressing demand for protection against governance and access risk.

The tape showed resilience without complacency.

Participation continued, but the bar for conviction rose.

This is how markets behave when uncertainty is structural rather than episodic.

POWER & POLICY

Normalized Friction Became The Baseline

Two policy dynamics sat beneath the tape throughout the day.

The first was shutdown risk.

Funding negotiations remain contentious, yet markets treated the threat as contained.

Investors have internalized that dysfunction clears eventually, even if the path remains messy.

The real shift is how quickly this behavior has been normalized.

The second was immigration and labor supply.

Combined with visible enforcement tension, it adds a legitimacy premium that markets quietly price where policy touches revenue.

Foreign policy reinforced the same theme.

Security guarantees tied to conditions in Ukraine signal a move toward transactional commitments.

That approach reduces ambiguity but increases modeling complexity.

Policy didn’t tighten today.

It clarified where friction lives.

From Our Partners

The New #1 Stock in the World?

A tiny company now holds 250 patents tied to what some call the most important tech breakthrough since the silicon chip in 1958.

Using this technology, it just set a new world speed record — pushing the limits of next-generation electronics.

Nvidia has already partnered with this firm to bring its tech into advanced AI systems.

This little-known company could soon become impossible to ignore.

ONE LEVEL DEEPER

Scarcity Replaced Fear As The Hedge Of Choice

Commodity behavior offered useful context.

Gold’s strength alongside stable equities reflects scarcity hedging rather than panic.

Investors are protecting against access risk, governance uncertainty, and policy optionality.

Energy fits that pattern.

Potential adjustments to Venezuela sanctions could ease supply constraints, yet the permission layer remains central.

Barrels matter, but authorization matters more.

Housing told a parallel story.

Rising contract cancellations highlighted affordability ceilings rather than demand collapse.

That dynamic influences consumption at the margin and feeds back into political pressure.

Markets are hedging limits, not endings.

U.S. MARKETS CLOSE

THE CLOSE

A Market That Knows What It Is Pricing

Today’s session reinforced the character of the tape.

Risk remains tradable.

Selection has become decisive.

Health care reminded investors what it means to rely on government pricing.

Trade pressure tightened the perimeter around technology and autos.

Logistics and industrial names earned capital by choosing clarity over complexity.

Gold stayed elevated as a hedge against governance and access risk rather than growth failure.

The core continues to hold.

The edges continue to reprice.

That combination defines a market strong enough to stand, and disciplined enough to choose.