TQ Evening Briefing

The tape held together, but the market quietly raised the cost of staying wrong.

MARKET STATE

Standards Tightened Inside a Stable Tape That Demands Results

Markets opened the month without stress, but not without friction.

Risk assets held their footing across the session, rates stayed orderly, and liquidity remained available.

The absence of dislocation mattered less than the way participation narrowed as the day progressed.

What changed from the prior letter was not direction, but tolerance.

The market stopped extending the benefit of the doubt.

Trades that could sustain scrutiny during intraday rotations retained sponsorship.

There was no urgency to press exposure late in the session.

Buyers stayed present, but selective.

Sellers were not aggressive, but patient.

Volatility expressed itself through dispersion rather than index movement, signaling digestion rather than continuation.

This was a market enforcing rules it has already learned.

Stability persisted, but flexibility declined.

Trade Implication:

Risk can still be carried, but the window for justification has narrowed.

Assumptions are being tested faster, and trades that require extended grace periods are losing support earlier in the lifecycle.

Positioning should reflect tighter review intervals and quicker invalidation thresholds.

Premier Feature

The Fed Didn’t Cut And Crypto’s Next Move Is Setting Up

The Fed just held rates steady, and in crypto, that often marks the start of major positioning before liquidity flows back in.

These macro transitions have kicked off some of the biggest runs in past cycles. But the real gains don’t go to every coin, they go to projects with real adoption, strong fundamentals, and infrastructure institutions are already using.

One coin is flashing those signals right now and still trades at a steep discount.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

WHAT’S ACTUALLY MOVING MARKETS

Funding Discipline Replaced Narrative Weight As Time Costs Rise

The primary driver beneath the surface was a shift in how capital priced time.

Markets treated recent credibility signals as settled inputs rather than catalysts.

That recalibration filtered through funding expectations.

Assets that benefited from prolonged accommodation or deferred accountability saw their premiums compress further, even without headline pressure.

The effect showed up in duration sensitivity and carry behavior.

Capital favored structures that could defend returns without leaning on future policy latitude.

This adjustment was incremental but persistent.

It did not force liquidation.

It simply repriced patience.

Execution Bias:

Trades that depend on long runways are encountering friction even in calm conditions.

Capital is still available, but it is less tolerant of strategies that rely on future flexibility rather than present resilience.

Timing and funding durability now matter as much as directional correctness.

Earnings Credibility Over Earnings Strength Filters The Growth Leaders

Earnings season continued to reinforce a subtle divide: results alone no longer determine sponsorship.

The market focused less on beats and misses and more on what earnings revealed about operating leverage, margin durability, and capital efficiency.

Companies demonstrating clean conversion paths retained support.

Where growth demanded escalating investment without near-term return, enthusiasm stalled quickly.

This was not skepticism about growth itself.

It was a recalibration of what qualifies as investable growth under current cost-of-capital conditions.

Capital remains willing, but less forgiving.

Trade Implication:

Earnings reactions will continue to hinge on cash-flow timing and balance-sheet logic rather than headline performance.

Strong results without clear conversion are increasingly treated as incomplete information.

Expect asymmetric reactions when capital intensity rises faster than proof.

Mechanical Clearing Finished Without Contagion Across The Global System

Volatility in select asset classes reflected position resolution rather than belief change.

The residual unwind in metals and crypto completed its adjustment cycle without spilling into credit or funding markets.

Price moves were sharp, but localized.

Liquidity absorbed pressure cleanly.

That containment mattered.

It signaled that leverage was being reduced methodically rather than forcibly.

The system processed excess without widening stress.

Mechanical clearing removed tail risk rather than creating it.

Execution Bias:

Dislocations driven by positioning remain tactical rather than systemic.

Sharp moves should be evaluated for structure and containment before being treated as regime signals.

Patience and trade construction matter more than speed in these environments.

From Our Partners

How to Claim Your Stake in SpaceX with $500

Every week Elon Musk is sending about 60 more satellites into orbit.

Tech legend Jeff Brown believes he’s building what will be the world’s first global communications carrier.

He predicts this will be Elon’s next trillion-dollar business.

And when it goes public, you could cash out with the biggest payout of your life.

TAPE & FLOW

Dispersion Did The Work While Leadership Rotated Within Sectors

Market behavior expressed itself through internal separation rather than directional force.

Leadership rotated within sectors instead of across them.

In equities, sponsorship followed visibility into margins, financing, and demand durability.

Selling pressure emerged where capital intensity rose faster than proof, but it remained controlled.

Buying interest persisted where assumptions held under scrutiny.

Rates stayed composed, but duration-sensitive exposure lacked conviction.

The focus stayed on future supply dynamics rather than immediate yield movement.

Cross-asset alignment held.

FX moved without disorder.

Energy responded to probability shifts rather than demand signals.

Liquidity remained present, but it stopped cushioning weak structures automatically.

This was not a momentum environment.

It was an audit.

Execution Bias:

Broad exposure can still function, but leadership will continue to rotate quickly.

Trades built on stretched assumptions are being challenged faster than before.

Active management and responsiveness are increasingly necessary to maintain edge.

POWER & POLICY

Optionality Shrinks Without Forcing Action Amid Data Flow Disruption

Policy developments expanded constraints without demanding immediate response.

That shift does not destabilize markets outright, but it raises sensitivity to funding signals and guidance credibility.

Trade and geopolitical headlines continued to matter only where trajectory shifted.

Energy markets discounted risk quickly as diplomatic channels reopened, reinforcing the idea that rhetoric alone no longer sustains premium.

Meanwhile, strategic initiatives around supply security and technology control continued to shape medium-term conditions without triggering repricing today.

The pattern is consistent.

Policy now alters valuation frameworks more than volatility profiles.

Trade Implication

Policy should be treated as a structural input rather than a headline catalyst.

Exposure sizing should assume uneven data flow and intermittent governance friction.

Optionality carries value, but assumed stability deserves a higher discount.

From Our Partners

Trump's Secret Retirement Fund

His salary is $400,000 a year. But his tax returns show he collects up to $250,000 a MONTH from one source.

It's not real estate.

It's not stocks.

ONE LEVEL DEEPER

Constraint Is Now Time-Based As Tolerance For Delay Shortens

The most important signal today was how restraint manifested without volatility.

Nothing fractured.

Nothing surged.

Yet the market spent the session shortening tolerance for delay.

Funding remained accessible.

Liquidity stayed open.

But trades leaning on extended timelines continued to lose sponsorship quietly.

This is how regimes tighten when confidence persists.

Through selection.

Through faster penalties for waiting.

Through dispersion instead of drawdowns.

A trade can be correct and still be mistimed.

A theme can remain valid while repricing lower due to financing friction.

That mechanism is now active.

Edge Setup:

Expect widening valuation gaps between exposures that convert quickly and those that require extended execution windows.

The trigger is not volatility, but delayed confirmation.

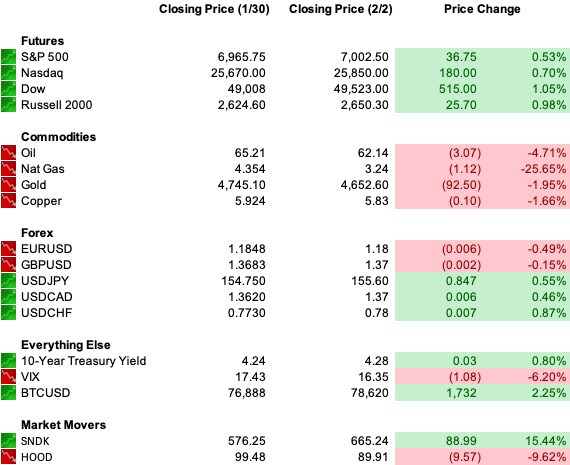

U.S. MARKETS CLOSE

THE CLOSE

Time Is No Longer Neutral While Capital Demands Early Confirmation

Markets did not pivot today.

They reinforced terms.

Risk remains viable.

Liquidity still clears.

But the price of delay rose again.

Capital now demands earlier confirmation, cleaner funding logic, and visible payoff paths.

Two paths remain open.

One assumes execution accelerates and validates current positioning.

The other assumes financing friction persists and forces further internal reallocation.

The market has not chosen.

But it has made clear that time carries a cost.