TQ Evening Briefing

Tariffs escalated. Capital flinched. The system priced political friction, not economic decay.

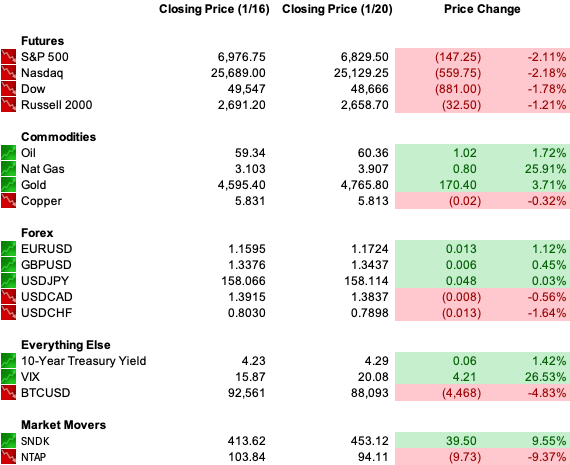

MARKET STATE

Structure Never Fully Failed

This was not a slow bleed.

It was a shock to assumptions.

Markets opened believing trade rhetoric would remain performative.

By midday, that belief collapsed.

The Greenland tariff threat forced capital to reprice U.S. assets as geopolitical instruments rather than neutral clearing venues.

Volatility jumped.

And yet, the system never lost mechanical control.

Credit functioned.

Liquidity stayed present.

There was no disorderly unwind.

That distinction matters. This was not panic. It was repricing under surprise constraint.

The selloff did not express doubt about earnings power or growth durability.

It expressed doubt about the reliability of policy boundaries.

Once tariffs were weaponized against allies for non-economic objectives, the market shifted from modeling outcomes to modeling retaliation, capital flight, and precedent.

This wasn’t about Greenland.

It was about whether U.S. assets still sit outside political leverage.

That question hit fast… and the tape responded accordingly.

Premier Feature

Want a Peek at Some Details of Alex Green's Own Portfolio?

Alex is one of a small circle of people to use this tiny company's groundbreaking AI technology... And he believes in it so strongly, he scooped up thousands of shares. You'll want to know what it is. DETAILS HERE.

WHAT’S ACTUALLY MOVING MARKETS

Tariffs Crossed From Trade Tool Into Coercion

The catalyst was clarity, not novelty.

This wasn’t about deficit correction or domestic protection.

It was about geopolitical compliance.

Markets treat that differently.

When tariffs become leverage rather than policy, the distribution of outcomes widens dramatically.

Allies retaliate.

Capital hesitates.

Treaties become conditional.

And risk premia reprice immediately.

Europe’s response mattered just as much.

The EU’s consideration of countermeasures, including its Anti-Coercion Instrument, introduced second-order capital risk.

This is no longer a bilateral dispute.

It’s a framework test.

That’s why equities sold broadly, yields rose, and the dollar weakened simultaneously.

This was not a growth scare.

It was a jurisdictional one.

Once tariffs moved from economics to enforcement, the market stopped waiting for confirmation and started protecting exposure.

“Sell America” Reemerged As A Capital Signal

The most telling reaction didn’t come from equities.

It came from bonds and currency.

Treasury yields jumped as the market priced marginal buyer hesitation.

Capital wasn’t just hedging volatility.

It was questioning sovereign reliability.

At the same time, the dollar sold off sharply while the euro strengthened.

That combination only appears when confidence, not growth, is being repriced.

Ray Dalio’s framing captured it cleanly: trade wars eventually turn into capital wars.

That dynamic doesn’t require mass selling to matter.

It only requires marginal buyers to hesitate.

Once that happens, yields rise even without inflation pressure, and equity multiples compress regardless of earnings trajectories.

This is why the tape felt heavy without feeling broken.

Capital didn’t flee.

It stepped back.

Safe Havens Worked… Except The Digital Ones

Gold wasn’t responding to inflation risk or recession fear.

It was responding to political unpredictability tied directly to capital flow risk.

Silver followed because it sits at the intersection of hedge and industrial scarcity.

Bitcoin notably traded like high-beta risk again.

The digital-gold narrative cracked as crypto sold off alongside equities.

In moments of geopolitical stress, markets still default to assets without governance layers, custodial risk, or regulatory exposure.

This divergence matters.

When safe havens work selectively, it tells you what the market is actually afraid of.

Today, it wasn’t monetary debasement or growth collapse.

It was rule instability.

Gold didn’t rally because things are breaking.

It rallied because trust just got more expensive.

EQUITIES IN FOCUS

Leadership Fractured Along Policy And Exposure Lines

Equity damage was broad, but not indiscriminate.

Nvidia, Tesla, Alphabet, and Apple were sold not because of fundamentals, but because they sit downstream of geopolitical friction.

Small caps held up better.

Their domestic revenue bias insulated them from immediate trade retaliation risk.

That relative strength wasn’t bullish… it was contextual.

Defense and energy names quietly absorbed capital.

Lockheed, Northrop, Huntington Ingalls, and Exxon hitting highs during a selloff is not coincidence.

It reflects where investors expect policy to protect cash flows rather than disrupt them.

Software and platform names at 52-week lows told the opposite story.

Anything priced on smooth global execution took weight.

This was not a factor unwind.

It was a jurisdictional rotation.

From Our Partners

WSJ says, "It's the $64 trillion question—will there be a stock market crash soon?" …

Weiss Ratings' research shows the first half of 2026 could be very tough for not all, but certain stocks...

Specifically, a radical shift is about to hit the market…

And it could send some of America's most popular stocks crashing down.

You'll want to see this list…

Because if you hold on to them — it could mean financial ruin.

To find out more about this incoming market shift — Including the five stocks to avoid — Click here now — before it's too late.

TAPE & FLOW

Fast Selling, But Still Within A Functional System

The tape moved quickly, but it never lost structure.

Volume expanded.

Breadth deteriorated.

The Nasdaq lost key technical levels.

These are real signals… but none crossed into systemic stress.

There was no credit freeze.

No funding scramble.

No forced liquidation cascade.

Instead, flow showed purposeful de-risking.

Investors reduced exposure where political optionality could rewrite cash-flow assumptions.

They maintained exposure where revenue is either domestic, protected, or policy-aligned.

That distinction explains why this felt violent but not chaotic.

This is how late-cycle markets behave when confidence is shaken without liquidity disappearing.

Risk is trimmed, not abandoned.

Hedges are paid for, not chased.

The tape wasn’t emotional.

It was surgical.

POWER & POLICY

Geopolitics Reentered Markets As An Active Constraint

Policy stopped being background noise today.

That alone changed how markets price future decisions.

Once precedent is set, repetition becomes a risk, not an exception.

European retaliation threats amplified that risk by introducing capital consequences, not just tariff offsets.

The possibility of restrictions on U.S. services and technology exports is what markets actually heard.

Layer on Treasury Secretary Bessent confirming an imminent Fed chair decision, and credibility risk deepened.

Markets don’t need a bad nominee to reprice independence.

They just need uncertainty to compress duration.

This wasn’t about the next rate cut.

It was about whether institutional buffers still hold.

Policy didn’t break markets today.

It narrowed the corridor they operate in.

From Our Partners

Buffett, Gates and Bezos Quietly Dumping Stocks—Here's Why

Warren Buffett just liquidated billions of shares. Bill Gates sold 500,000 shares of Microsoft. Jeff Bezos filed to sell Amazon shares worth $4.8 billion.

What is going on? One multi-millionaire believes they are preparing for a catastrophic event. But not a crash, bank run, or recession. It’s something we haven’t seen in America for more than a century.

ONE LEVEL DEEPER

This Was A Confidence Shock, Not A Growth One

Nothing in today’s tape suggests demand is collapsing.

Earnings season is just beginning.

Loan growth remains intact.

Consumption hasn’t cracked.

The economy didn’t suddenly deteriorate.

What changed was belief.

Belief that trade tools would remain economic.

Belief that alliances would stay insulated.

Belief that capital rules wouldn’t shift abruptly.

When belief is challenged, markets move first and rationalize later.

This is why the selloff was sharp.

And why it may not immediately reverse.

Confidence shocks don’t resolve with data.

They resolve with behavior.

U.S. MARKETS CLOSE

THE CLOSE

Today wasn’t about valuation or earnings risk.

It was about whether U.S. assets are still governed by predictable rules.

The market answered quickly.

It sold what depends on global cooperation, bid what benefits from enforcement, and paid for hedges tied to credibility risk.

Nothing broke.

But something changed.

The system still works.

It’s just charging more for certainty.

And until policy boundaries stabilize, markets will keep trading that premium… quietly, deliberately, and without apology.