TQ Morning Briefing

Risk is still holding. But Europe is starting to price America as a counterparty, Russia is cheering the fracture, and the Fed is being pulled into the same credibility trade.

MARKET STATE

The Tape Still Holds, But The System Is Now Pricing Alliance Risk As A Variable

This morning is not about a single move in futures. It is about a shift in the layer beneath them.

Equities can still hold posture. AI capex is still flowing. Earnings still matter.

But the geopolitical container has not resealed. It widened.

The Greenland fight is no longer being treated like a headline cycle. It is being treated like an institutional stress test.

The question is not whether Trump gets Greenland. The question is whether the Western alliance is still a fixed asset or a tradable relationship.

And the tape already knows the answer is changing. Not in panic. In re-pricing.

That is why the “sell America” mix showed up yesterday.

Equities down, dollar weaker, yields up.

That is not a recession signal. That is a credibility signal.

It just requires higher confidence to stay that way.

Premier Feature

The #1 Memecoin Opportunity to Start the New Year

While the broader crypto market struggled, analysts Brian and Joe kept finding explosive memecoin gains — including 1,100% in 2 days, 600% in a single day, and even 8,200% in months.

These weren’t lucky bets. They use a proprietary system designed to spot memecoins with momentum before they take off — regardless of market conditions.

Now they’ve identified their #1 memecoin for January 2026. It’s still trading at pennies, with viral potential, real utility, and a setup that could thrive if a New Year rally takes hold.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

WHAT’S ACTUALLY MOVING MARKETS

Greenland Turned NATO From A Security System Into A Negotiation Table

The escalation is not the rhetoric. It is the precedent.

Tariffs as a trade tool are modelable. Tariffs as territorial leverage are doctrine. And doctrine forces allies to think in contingencies, not intentions.

Europe is reacting accordingly.

Publicly, the message is calm and unity. Privately, the question is how to deter an ally without detonating the alliance.

That is the real shock.

The U.S. is not being priced as the stabilizer of Europe. It is being priced as a potential source of coercion risk.

Once that possibility enters the market, it becomes tradable.

Russia Isn’t Just Watching. It’s Validating The Break

Moscow’s reaction is the tell.

When the Kremlin starts flattering Trump and calling NATO “in deep crisis,” it isn’t commentary. It is confirmation that the alliance fracture is producing strategic advantage without a shot fired.

Lavrov comparing Greenland to Crimea is the psychological escalation.

It frames Greenland as a land-grab precedent, not a security adjustment.

That is exactly what European leaders fear most: that the norms of sovereignty become optional when power wants something.

Russia’s near-term risk is that the U.S. expands its Arctic footprint. But Russia’s near-term opportunity is bigger: instability inside NATO.

That is why they’re cheering the rift, not hedging it.

The “Sell America” Trade Is Not Anti-Growth. It’s Anti-Unpredictability

Yesterday’s price action wasn’t about earnings durability breaking.

It was about global capital recalculating whether U.S. assets still sit above politics.

When foreign capital begins to imagine repatriation, even at the margin, the pattern changes.

Equities can fall without a recession.

The dollar can weaken without a growth gap.

Yields can rise without inflation re-accelerating.

Because the move is about term premium becoming political premium.

It’s about the cost of holding the system’s collateral when the rules feel conditional.

That’s what the market was expressing. Not fear. A new discount.

From Our Partners

Gold to SOAR as early as January 28th

Many are wondering why so many countries are frantically buying gold right now.

The truth is that this is just the beginning of a much larger story... One that could send gold soaring to even bigger highs this month.

But the best way to cash in on gold's upside potential might surprise you.

TAPE & FLOW

The Tape Is Still Risk-On, But Hedging Is Now Structural

The market still wants to be long.

You can see it in the refusal of credit to break. You can see it in the way equity weakness is still being treated as posture, not unravel.

But the flow behavior is changing.

The tape is narrowing around things that can function under interference.

It rewards bottlenecks.

It rewards control.

It rewards businesses with pricing power that does not require political calm.

This is why you can get a world where indexes stabilize, but protection refuses to cheapen. Why gold stays firm. Why the long end remains jumpy.

The tape is not fragile. It is conditional. And the condition is credibility.

POWER & POLICY

Europe’s Response Is A Capital Allocation Story, Not A Tariff Story

The loud response is retaliation lists. The quiet response is portfolio logic.

Europe has been one of the deepest external lenders to America.

If Europe begins to treat the U.S. as a less reliable repository for savings and security, the real repricing begins.

That does not require a coordinated selloff. It requires permission for the idea to become normal.

That’s why Bessent calling Denmark “irrelevant” matters. Not because Denmark is systemically important.

Because dismissing allies while asking the world to fund your deficits is the wrong signal to send in a credibility tape.

The market is not assigning collapse probabilities.

It is assigning higher friction. And friction shows up first in funding.

The Fed Independence Fight Is The Same Credibility Trade, Just Domestic

This is the second channel the market is watching.

Not because it changes the next meeting. Because it changes the long-term pricing of the hedge.

The Supreme Court hearing tied to Lisa Cook is being treated as a test of insulation.

And Bessent’s escalating public pressure campaign on Powell is being treated as an attempt to make the Fed legible to politics.

If the market concludes that independence is discretionary, duration becomes harder to own.

Not because rates must rise. Because the hedge stops being pure.

This is why the curve reacts before the economy does.

The market doesn’t wait for policy consequences to appear in CPI.

It prices the governance regime shift immediately in term premium.

ONE LEVEL DEEPER

The New Rule Is Political Credibility Moves Faster Than Economic Reality

The market used to treat politics as theater and economics as truth.

That split is fading.

Now politics can move the discount rate faster than fundamentals can move earnings.

Because policy isn’t a forecast anymore. Policy is a variable.

And that mechanically tightens financial conditions without a single hike.

Not through higher front-end rates. Through higher uncertainty around the rules of engagement.

So equities can hold posture.

But participation becomes more expensive.

Not through a volatility spike. Through higher hedging costs, more duration sensitivity, and a higher required confidence threshold.

This is not a collapse tape. It is a proof tape.

The market is watching which institutions still have enforcement power.

From Our Partners

The Greatest Stock Story Ever?

I had to share this today.

A strange new “wonder material” just shattered two world records — and the company behind it is suddenly partnering with some of the biggest names in tech.

We’re talking Samsung, LG, Lenovo, Dell, Xiaomi… and Nvidia.

Nvidia is already racing to deploy this technology inside its new AI super-factories.

Why the urgency?

Because this breakthrough could become critical to the next phase of AI. And if any tiny stock has the potential to repeat Nvidia’s 35,600% climb, this might be it.

MARKET CALENDAR

Economic Data: Pending Home Sales

Earnings: J&J (JNJ), Charles Schwab (SCHW), ProLogis (PLD), Kinder Morgan (KMI), Travelers Companies (TRV), Truist Financial (TFC)

Overnight: Nikkei -0.41%, Shanghai +0.08%, FTSE 100 +0.24%, DAX -0.88%

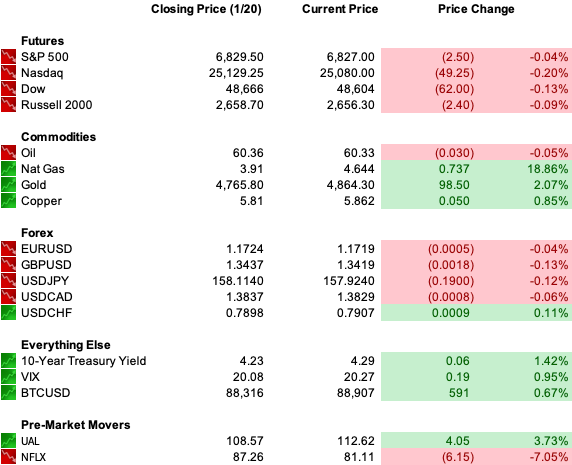

U.S. PRE-MARKET

THE CLOSE

The market is still holding risk because growth is still alive and the AI buildout is still funded.

But the system around it is being repriced.

Greenland is not the issue.

It is the precedent test.

And Russia cheering the NATO crack tells you exactly why it matters.

At the same time, the Fed is being pulled into the same credibility regime shift.

When alliances become transactional and institutions become negotiable, the discount rate rises even if the economy doesn’t slow.

The tape isn’t breaking.

It’s recalibrating what it takes to stay long.

This is still a growth market.

But it’s a growth market with a political premium.