TQ Evening Briefing

Calm held on the surface. Markets priced constraint, discretion, and physical scarcity as live variables again.

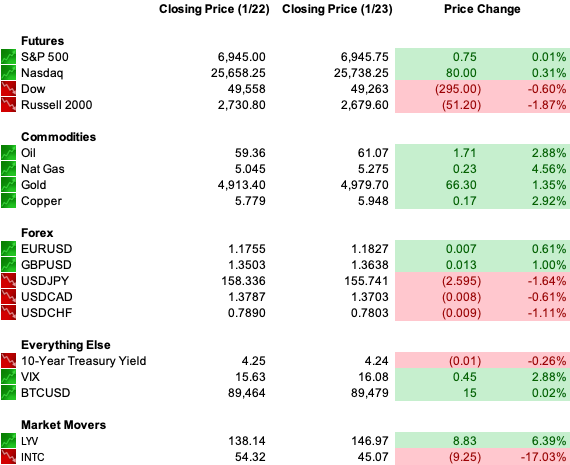

MARKET STATE

Stability Held While The Container Narrowed

Today was quieter in price and louder in structure.

Indexes drifted without drama.

Volatility softened.

Breadth didn’t fracture.

On the surface, it looked like digestion after a volatile stretch.

Underneath, the market continued tightening the definition of what qualifies as investable risk.

Capital showed willingness to stay exposed, but the guardrails became clearer.

Assets tied to access, infrastructure, and enforceable operating frameworks stayed supported.

Anything reliant on stable diplomacy, cooperative governance, or assumption-based continuity continued to trade with hesitation.

The takeaway wasn’t directional.

It was conditional.

Markets are learning to operate inside containment rather than assuming expansion.

That distinction matters because it allows participation without enthusiasm and resilience without confidence.

This is no longer a tape that needs good news to function.

It needs the absence of surprise.

When that condition holds, risk can stay on.

When it doesn’t, repricing happens quickly and without apology.

The market didn’t lose balance today.

It tightened its footing.

Premier Feature

The 7 Stocks Built to Outlast the Market

Some stocks are built for a quarter… others for a lifetime.

Our 7 Stocks to Buy and Hold Forever report reveals companies with the strength to deliver year after year - through recessions, rate hikes, and even the next crash.

One is a tech leader with a 15% payout ratio - leaving decades of room for dividend growth.

Another is a utility that’s paid every quarter for 96 years straight.

And that’s not all - we’ve included 5 more companies that treat payouts as high priority.

These are the stocks that anchor portfolios and keep paying.

This is your chance to see all 7 names and tickers - from a consumer staples powerhouse with 20 years of outperformance to a healthcare leader with 61 years of payout hikes.

WHAT’S ACTUALLY MOVING MARKETS

Strategic Platforms Moved From Regulation Into Architecture

The TikTok outcome remains the clearest signal of where governance is headed.

The platform wasn’t defended through legal compromise.

Data custody, algorithm training, and operational oversight became the solution set.

That shift carries precedent.

Strategic platforms no longer negotiate at the edge of regulation.

They get pulled inside it.

Once that template exists, adjacent platforms trade differently because viability becomes a function of compliance architecture rather than user demand.

Markets recognized this as a structural change.

Not punitive.

Not exceptional.

Repeatable.

That recognition feeds directly into valuation.

Companies capable of building inside those constraints gained relative appeal.

Those that cannot face a widening governance discount, regardless of growth profiles.

Executive Discretion Re-Entered The Pricing Model

Policy authority also showed up through speed rather than debate.

In modern conflict, action moves faster than process.

Sanctions, seizures, and targeted enforcement rarely arrive with formal declarations.

That increases the number of pathways where disruption can occur without warning.

Volatility doesn’t collapse cleanly in that environment.

It compresses and waits.

Markets responded accordingly.

Risk stayed engaged, but hedges retained value.

Discretion now carries premium because it introduces asymmetry that fundamentals alone cannot hedge.

Alliance Reliability Shifted From Baseline To Variable

Assumptions did not fully recover.

The recalibration isn’t about one dispute cooling.

It’s about alliance behavior becoming optional rather than automatic.

Once that shift registers, contingency planning becomes policy, not paranoia.

Europe’s continued discussion around reducing exposure across software, payments, and communications reflects operating necessity rather than ideology.

Markets read that clearly.

Capital doesn’t require fragmentation to reallocate.

Optional behavior alone is enough to change hedging practices, FX posture, and supply chain investment.

That process continued quietly today.

From Our Partners

Futurist Eric Fry says it will be a "Season of Surge" for these three stocks

One company to replace Amazon... another to rival Tesla... and a third to upset Nvidia.

These little-known stocks are poised to overtake the three reigning tech darlings in a move that could completely reorder the top dogs of the stock market.

Eric Fry gives away names, tickers and full analysis in this first-ever free broadcast.

EQUITIES IN FOCUS

Governance And Physical Scarcity Led Selection

Equity leadership stayed aligned with the regime.

Names tied to enforceable infrastructure and compliance rails outperformed.

Oracle traded as a governance beneficiary rather than a legacy enterprise play.

As platforms get redesigned to fit national security frameworks, the companies providing compliant rails gain strategic relevance.

Strength in natural gas reflected grid stress and reliability risk rather than growth optimism.

Oil stayed sensitive to geopolitical posture, reinforcing energy’s role as the fastest transmission channel for inflation anxiety.

AI infrastructure held firm, though enthusiasm shifted toward capacity and bottlenecks rather than narrative momentum.

Compute, grid access, and security layers attracted capital because they remain essential even when politics accelerates.

The equity signal stayed consistent.

Growth remains viable.

Control determines durability.

Compounding now favors businesses that operate smoothly under constraint rather than those optimized for frictionless expansion.

TAPE & FLOW

Participation Held While Filters Tightened

Today’s tape felt orderly and selective.

Liquidity functioned.

Credit stayed composed.

Volatility ebbed without breaking structure.

That allowed indices to drift higher without chasing behavior or forced covering.

Flows showed increasing filtration.

Capital favored platforms capable of surviving inside regulation, infrastructure that remains scarce, and producers that benefit from constraint rather than abundance.

Duration exposure stayed cautious as political uncertainty continues to attach itself to term structures.

The metal isn’t trading panic.

It’s trading persistence of uncertainty.

This combination explains why rallies feel controlled rather than exuberant.

Risk is still embraced, but it now requires justification beyond momentum.

Confirmation matters more.

Optionality stays priced.

The market isn’t pulling away from exposure.

It’s tightening its standards.

POWER & POLICY

Containment Emerged As The Dominant Macro Lens

Across headlines, a single theme kept surfacing.

Control through corporate structure.

Control through discretionary authority.

Control through contingency planning.

Control through physical scarcity.

These aren’t isolated stories.

They form a framework markets are now using to interpret macro risk.

Earnings matter.

Data matters.

Governance volatility now matters just as much.

Energy reinforced that framework today.

Natural gas strength reflected grid fragility and weather sensitivity.

Oil stayed bid on geopolitical posture.

Physical constraint reasserted itself as a pricing force.

As conditions tighten, financing risk concentrates in structures that rely on smooth rollovers rather than cash generation.

What matters now is not defaults.

It’s behavior.

Any product that promised “income with liquidity” is vulnerable to the first wave of real redemption pressure, because the underlying assets clear slowly even when the wrapper is marketed as stable.

Watch for the early tells: distribution trims, gated exits, NAV lag versus public credit, and widening discounts where retail access rails are forced to prove they can handle outflows.

Markets are watching that quietly, not urgently.

Policy didn’t tighten today.

The tolerance band narrowed.

From Our Partners

January’s #1 Memecoin — Still Trading for Pennies

Memecoins don’t move slowly — they explode.

We’ve seen runs of 600% in a day, 1,100% in 48 hours, and 8,200% in months when momentum hits.

Right now, the market is oversold and fear is high — the exact setup that often precedes powerful January rallies. And when crypto turns higher, memecoins don’t just follow… they lead.

That’s why analysts Brian and Joe just flagged their #1 memecoin for January 2026. It’s still trading at pennies, with viral energy, real utility, and a capped supply with a built-in burn.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

ONE LEVEL DEEPER

Governance Risk Became A Real Rate Input

Markets used to treat politics as noise layered on top of economics.

Policy discretion now moves discount rates faster than data moves revenue.

Once credibility becomes conditional, uncertainty embeds itself into valuation through higher required returns rather than higher front-end rates.

This tightening happens without central bank action.

It expresses itself through wider spreads, persistent hedging demand, and preference for assets that survive interference.

The system is adapting to that reality.

It’s functioning.

It’s just more expensive to navigate.

U.S. MARKETS CLOSE

THE CLOSE

Calm Held, Constraint Stayed Priced

The afternoon clarified rather than disrupted.

Strategic platforms are being absorbed through structure.

Executive discretion remains a macro input.

Europe is stabilizing the moment while adjusting dependency.

Energy reasserted itself as the quickest path back to inflation anxiety.

Risk stayed on.

Discipline stayed intact.

This market can still climb.

It now does so inside a regime where governance trades like a spread.

And into the close, that spread remains the price every position has to earn back.