TQ Evening Briefing

Relief stabilized the tape. Credibility stayed expensive. Access replaced ownership as the compromise.

MARKET STATE

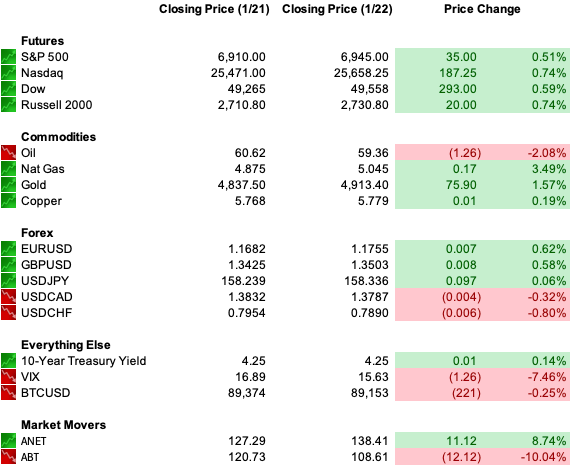

Relief Held, Assumptions Stayed Repriced

The market spent today absorbing information rather than chasing headlines.

Greenland tension eased.

Tariff language softened.

Equities stabilized, but duration never got full relief and gold stayed firm, confirming the market is still paying for political variance.

That part was mechanical.

What mattered more was how little of yesterday’s repricing came back out.

Investors didn’t treat the de-escalation as a return to familiarity.

They treated it as evidence that uncertainty can surface abruptly and linger longer than volatility does.

That distinction shaped positioning throughout the session.

Participation improved, but it stayed selective.

Duration remained constrained.

The discount rate reflected political optionality that hadn’t existed a week ago.

This was a market willing to re-engage without rushing to forget.

Capital accepted upside while quietly adjusting its tolerance for surprise.

That posture kept rallies intact without loosening discipline.

Confidence didn’t disappear.

It became conditional.

Premier Feature

10 Stocks for Income and Triple-Digit Potential

Why choose between growth or income when you can have both?

Our new report reveals 10 “Double Engine” stocks — companies built for rising dividends and breakout price gains.

Each has the scale, cash flow, and catalysts to outperform as markets rotate after the Fed’s pivot.

These are portfolio workhorses — reliable payouts today, compounding gains tomorrow.

WHAT’S ACTUALLY MOVING MARKETS

Greenland Was Translated Into A Durable Security Arrangement

The key development wasn’t the pause.

It was the framework.

Greenland shifted from a sovereignty question into a security and access conversation.

NATO posture in the Arctic, expanded U.S. basing rights, and filtered investment pathways replaced acquisition rhetoric.

Tariffs remained nearby as leverage rather than front-line policy.

Markets read that as a workable operating model.

Escalation risk narrowed.

Structural precedent remained.

That combination allowed risk to recover without compressing the political premium embedded yesterday.

Europe accepted the off-ramp while openly discussing countermeasures.

That dual response mattered.

It showed cooperation alongside preparation.

Capital priced optionality instead of certainty.

The tape reflected relief without complacency.

Ukraine Expectations Were Pulled Forward Into Pricing

Ukraine moved through markets with less noise and more impact.

The sequencing mattered because it invited markets to assign probability before details emerged.

Credit responded first.

Ukrainian bonds tightened as investors priced a higher chance of cessation.

That behavior signaled anticipation rather than belief.

When fixed income moves ahead of narrative, expectations have shifted.

This created asymmetry.

Progress would reinforce the rally.

Delay would reintroduce volatility quickly because positioning moved early.

Markets didn’t bet on outcomes.

They adjusted exposure to timing.

Institutional Boundaries Entered The Valuation Layer

Domestic governance headlines carried quiet weight.

Reports around ICE enforcement authority introduced questions about procedural limits and discretion.

Markets track rule clarity because predictability anchors capital allocation.

When boundaries appear flexible, friction rises.

That friction shows up through litigation risk, compliance complexity, and corporate caution.

None of it breaks growth.

All of it raises the cost of holding duration.

Investors adjusted accordingly.

From Our Partners

DOGE Phase 2?

Musk's days in politics aren't over yet.

That's according to tech legend Jeff Brown, who believes Musk and Trump may be working on DOGE Phase 2…

And, this time, it could cause a $12 trillion market megashift.

If recent market swings caught you off guard…

EQUITIES IN FOCUS

Control And Access Continued To Define Leadership

Equity leadership remained consistent with the broader regime.

AI infrastructure demand stayed firm.

Domestic manufacturing optionality retained value because redundancy now carries policy support.

Strategic positioning mattered more than near-term precision.

Apple reinforced the same theme from the interface layer.

Siri’s evolution signaled renewed focus on owning the conversational surface.

Control over interaction loops continues to determine leverage as assistants reshape workflows.

Software participation stayed narrow.

Infrastructure, security, and physical bottlenecks continued attracting capital.

The equity message stayed focused: growth still pays, control determines who compounds.

TAPE & FLOW

Risk Re-Engaged Under Tighter Filters

The tape held together cleanly.

Volatility eased without collapsing.

Credit markets stayed orderly.

Liquidity functioned.

That allowed equities to extend gains without forcing macro validation.

Flow patterns showed discipline.

Capital favored assets resilient to interference.

Domestic exposure, energy, defense, and infrastructure remained supported.

Duration sensitivity persisted as political factors influenced term structures.

Institutional participation stayed measured.

Positioning reflected comfort rather than urgency.

The market showed willingness to carry risk alongside an insistence on confirmation.

That balance kept rallies intact while limiting overextension.

Confidence returned with guardrails.

POWER & POLICY

Affordability Pressure Entered Profit Conversations

Affordability themes moved closer to policy action.

Governors and lawmakers floated caps, refunds, and restrictions with growing seriousness.

That framing matters for profitability outlooks.

This environment doesn’t challenge growth directly.

It introduces ceiling risk where optics collide with pricing power.

Markets adjusted toward businesses able to defend margins structurally rather than exercise them aggressively.

Corporate Communication Turned Cautious

Executive tone shifted visibly.

The goal appeared to be maintaining predictability while avoiding entanglement.

That posture narrows the corridor for guidance.

When corporate communication tightens, uncertainty widens.

Spreads respond accordingly.

Markets picked up on that signal.

From Our Partners

You Missed the Crypto Bottom — This Is the Do-Over

Let’s be real.

Most investors froze at the bottom. Fear won. That window is gone.

But the recovery just opened a second chance — and in some ways, it’s even better. This time, there’s confirmation.

The crash wiped out hype and exposed which cryptos actually matter. What survived? Fundamentals.

One crypto is flashing the same setup we saw before massive runs:

8,600% (OCEAN)

3,500% (PRE)

1,743% (ALBT)

Strong on-chain data. Growing network. Active development.

Yet the price still hasn’t caught up.

That gap won’t stay open for long.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

ONE LEVEL DEEPER

Productivity And Predictability Are No Longer Paired

The underlying adjustment continued to surface.

Global capital still recognizes American productivity, innovation, and earnings power.

At the same time, predictability now carries a price.

Alliances showed vulnerability.

Rules appeared elastic.

Policy demonstrated improvisation.

None of that negates growth.

It reframes its cost.

Investors adjusted to a landscape where returns require compensation for political variance.

That adjustment isn’t bearish.

It’s structural.

U.S. MARKETS CLOSE

THE CLOSE

Relief Priced, Political Risk Stayed Embedded

Today delivered stabilization without erasure.

Greenland cooled.

Markets recovered.

The lesson remained.

Europe recalibrated leverage exposure.

Ukraine expectations moved forward in credit.

Domestic governance entered valuation inputs.

Confidence required reinforcement.

This remains a market that can climb.

It now charges more for certainty.

Into the close, that surcharge remains the spread every position has to earn back.