TQ Evening Briefing

Relief found footing. Structure stayed intact. Credibility kept its premium.

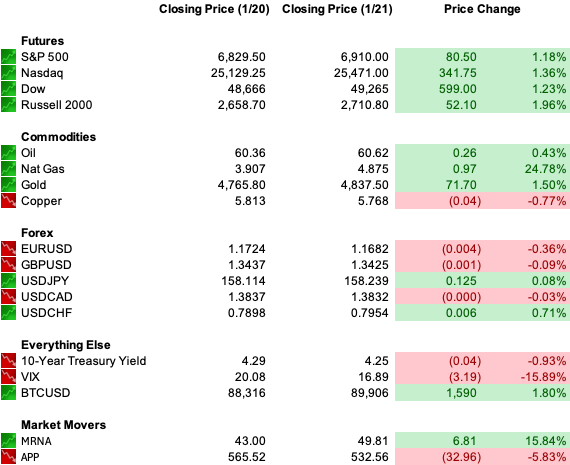

MARKET STATE

Relief Found A Bid, Conditions Still Applied

The market didn’t spend today undoing yesterday.

It spent today deciding how much damage had already been done.

Risk came in cautious and left more comfortable, but not convinced.

The immediate shock from tariff threats aimed at allies lost urgency as the session wore on, and that alone eased pressure across volatility and funding markets.

Once escalation slipped out of the front window, positioning loosened.

Equities responded quickly. Small caps ran hardest. Index pressure lifted.

The reflex made sense.

Yet the broader container never snapped back to normal.

Participation stayed selective.

Leadership gravitated toward areas that can operate through political friction without requiring smooth coordination or institutional grace.

That bias mattered more than the index bounce itself.

This remains a market willing to hold exposure, but only where the rules feel legible under stress.

The session wasn’t about confidence returning.

It was about timelines extending.

Relief traded.

Belief stayed measured.

Premier Feature

90% of AI Runs Through This Company

The biggest AI wins often come from companies you don’t hear about every day.

Case in point:

The database provider now embedded into the big three cloud platforms - with access to 90% of the market.

You’ll find the name and ticker of this newly-minted giant in our 10 Best AI Stocks to Own in 2026 report, along with:

• The chip giant holding 80% of the AI data center market.

• A plucky challenger with 28% revenue growth forecasts.

• A multi-cloud operator with high-end analyst targets near $440.

Plus 6 other AI stocks set to take off.

WHAT’S ACTUALLY MOVING MARKETS

Greenland Headlines Reduced Immediacy, Not Precedent

The rally followed a shift in tone, not an answer.

Trump’s comments moved the Greenland situation out of enforcement language and into negotiation language.

“Framework” and “concept” narrowed the range of near-term outcomes, and that was enough for the market to stop pricing rupture as imminent.

That distinction matters.

Capital doesn’t need certainty to move.

It needs probabilities to stabilize.

Once escalation stopped looking immediate, risk capital could step back in without having to solve the entire geopolitical puzzle.

What didn’t change was the lesson embedded yesterday.

Tariffs remain available as leverage against allies.

That precedent stayed in place.

Today’s move simply priced time.

That’s why the rally felt orderly rather than emotional.

The market adjusted urgency, not conviction.

GEOPOLICY WATCH

Greenland’s Reframing Kept Credibility In Play

Beneath the relief sat a different message.

Greenland is no longer framed as cooperation or alignment.

It is being framed as infrastructure.

Security architecture, mineral access, and long-term control replaced partnership language, and markets noticed.

This reframing alters how alliances are valued.

When sovereign territory becomes a permanent asset rather than a shared interest, relationships shift from durable to conditional.

Capital responds accordingly.

No one is trading morality here.

The market is pricing downstream effects: enforcement tools gaining permanence, and coordination becoming transactional.

That’s why credibility stayed on the balance sheet even as equities rallied.

Timing pressure eased.

Structural questions did not.

RATES WATCH

Fed Insulation Entered The Same Pricing Channel

Questions focused on process and institutional risk rather than speed or removal.

That reduced immediate disruption risk, but it didn’t remove the signal.

Independence is now openly debated.

Markets treat insulation as a form of collateral.

Once that collateral becomes conditional, duration math changes.

Term premium adjusts.

Long-dated confidence requires compensation.

This isn’t about inflation forecasts or policy paths.

It’s about whether the protective shell around the Fed remains automatic.

That question stayed live into the close.

From Our Partners

The Panic That Creates Millionaires Is Here

Legendary investors built fortunes by buying during moments of panic—and right now, fear is everywhere in crypto.

Red charts, sharp selloffs, shaken confidence. This is exactly when the biggest opportunities tend to form.

Every major bull run includes violent pullbacks that force weak hands out before the rebound begins.

The crypto I’m watching is showing strength beneath the surface: rising network usage, increasing development activity, steady revenue, and prices still well below prior highs.

We’ve identified massive winners before, and this setup looks even stronger.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

EQUITIES IN FOCUS

Capacity, Control, And Interfaces Drove Leadership

Intel’s move carried more information than optimism.

AI infrastructure demand remains real, and domestic manufacturing optionality carries political sponsorship.

That combination reframes the name inside this regime.

Foundry credibility, node execution, and government alignment matter more than near-term margins here.

The tape rewarded that clarity.

Apple’s Siri shift told a parallel story.

By reasserting ownership of the conversational layer, Apple reminded the market that distribution still beats novelty.

Elsewhere, software stayed selective.

Infrastructure, security, and physical bottlenecks continued to attract capital.

The message was consistent across sectors.

Growth still works.

Control decides who gets paid for it.

TAPE & FLOW

Participation Reopened, Filters Never Left

Today’s tape relaxed without losing discipline.

Volatility cooled.

Credit stayed composed.

Funding never strained.

That allowed equities to rebound without forcing macro confirmation or policy rescue narratives.

But flow told a narrower story.

Capital rotated toward assets that remain functional when coordination weakens.

Domestic exposure, infrastructure, and capacity names led.

Assets that require stable politics and institutional harmony to justify multiples lagged.

Small caps benefited from revenue insulation.

Mega-cap tech rebounded selectively, with leadership concentrating in names tied to platforms or physical throughput.

This wasn’t a chase.

It was a controlled re-entry.

The market isn’t abandoning risk.

It’s continuing to audit it, position by position.

POWER & POLICY

Credibility Became An Active Transmission Mechanism

Policy moved markets today through expectation rather than action.

Tariffs aimed at allies altered how U.S. assets are evaluated at the margin.

The “sell America” impulse softened, but sensitivity increased.

Treasury demand stabilized, yet confidence now carries qualifiers.

At the same time, the Fed independence debate shifted from background noise into an active pricing input.

Leadership succession and removal mechanisms are now openly discussed, and that visibility alone narrows tolerance bands.

Falling pending sales reflected hesitation, not collapse.

Commitment is becoming costly, and uncertainty shows up there early.

Policy didn’t tighten.

The margin for error did.

Markets are adjusting to enforcement that is explicit, insulation that is conditional, and credibility that must be earned continuously.

From Our Partners

How to Claim Your Stake in SpaceX with $500

Every week Elon Musk is sending about 60 more satellites into orbit.

Tech legend Jeff Brown believes he’s building what will be the world’s first global communications carrier.

He predicts this will be Elon’s next trillion-dollar business.

And when it goes public, you could cash out with the biggest payout of your life.

ONE LEVEL DEEPER

Custody Failures Translate Directly Into Risk Premiums

The DOGE disclosure around Social Security data wasn’t a sideshow.

It was a custody signal.

Markets care deeply about control, accountability, and system boundaries.

When institutions cannot clearly account for sensitive data, trust erodes quickly.

That erosion doesn’t need scale to matter.

Ambiguity is enough.

This fits cleanly into the broader regime.

Credibility is operational.

When systems admit uncertainty, markets respond by demanding compensation.

That’s why today’s rally didn’t erase yesterday’s repricing.

Trust is being evaluated component by component.

The premium doesn’t vanish when volatility cools.

It migrates.

U.S. MARKETS CLOSE

THE CLOSE

Relief Priced. Certainty Still Costs.

Today delivered breathing room, not closure.

Greenland rhetoric softened and the market responded mechanically.

Volatility eased.

Risk reopened.

Liquidity held.

But the structural signals stayed intact.

Allies can be pressured.

Independence can be questioned.

Enforcement can arrive abruptly.

Fed insulation remains under review.

Housing shows hesitation.

AI capacity stays funded.

Platform control regained value.

Institutional custody risk surfaced publicly.

Nothing broke. Nothing reset. This market still functions.

It simply charges more for confidence.

And into the close, that toll remains the most important number on the screen.