TQ Evening Briefing

CPI removed the immediate rate threat. AI removed the illusion of safety. The macro cleared, but the internal sorting accelerated. Capital stayed in equities. It just abandoned anything without structural leverage.

MARKET STATE

Inflation Relief Arrives As Markets Sort Winners From Losers

Inflation relief arrived this morning and the rate complex responded quickly.

Shelter decelerated.

Energy helped.

The front end eased.

The 10-year drifted lower.

June cut probabilities firmed back toward the low-80% range.

That matters because the market entered the session vulnerable to another duration squeeze.

Instead, it regained rate stability.

Equities stabilized, but the rebound was conditional.

Names that broke on automation risk did not recover simply because inflation cooperated.

Lower rates are no longer enough to rescue exposed business models.

Hardware, semiconductor equipment, and infrastructure-linked exposures held sponsorship.

Labor-heavy intermediation models remained pressured.

Crude slipped again toward the low $60s as supply expectations expanded.

Gold steadied. The dollar stayed soft. The macro overhang lightened.

The internal hierarchy did not revert.

Trade Implication

With CPI aligned and the front end anchored, duration pressure recedes.

Positioning shifts back to earnings durability and capital intensity rather than rate beta.

PREMIER FEATURE

Nuclear Stocks Are Doing Something Unexpected

Nuclear energy is moving back into the spotlight as power demand surges and grid reliability becomes a priority.

Cash flow is improving, long-term contracts are locking in revenue, and capital is rushing back into parts of the sector that were ignored for years.

Our analysts believe this shift is happening faster than most investors realize.

Their FREE report reveals 7 Top Nuclear Stocks to Buy Now, including high-growth uranium plays and steadier contract-backed names.

WHAT ACTUALLY MOVED MARKETS

CPI Removed The Immediate Policy Threat To Market Stability

The key mechanism was rate stabilization, not enthusiasm.

The market did not celebrate the print. It recalibrated around it.

Cooling shelter and contained core services prevented a policy repricing under incoming Fed leadership.

The data did not confirm a rapid disinflationary trend, but it reduced the probability of renewed hawkish signaling in the near term.

That shift affects discount rates and financing assumptions across risk assets.

Lower volatility in the two-year compresses the range of policy outcomes.

When the rate path narrows, capital redeploys into cash flow.

It does not redeploy into hope.

Electricity inflation, however, continues to run above headline CPI.

That signals emerging cost pressure tied to infrastructure demand rather than consumer overheating.

It sits outside the shelter narrative and may re-enter the discussion later in the year.

Execution Bias

When inflation moderates without growth deterioration, allocate toward earnings visibility and operating leverage tied to tangible demand rather than speculative duration exposure.

Automation Risk Repriced Intermediation As Margin Credibility Faces Scrutiny

The second mechanism was margin credibility.

The repricing that began in software extended into brokerage, analytics, logistics, and advisory-heavy platforms.

The catalyst was plausibility.

Investors no longer ask if automation can compress margins. They are asking how quickly.

AI tools are no longer conceptual productivity enhancements; they are viable substitutes for labor-intensive processes.

Fee density is being reassessed.

Where value creation relied on information asymmetry and human throughput, pricing power now looks fragile.

Private credit exposure adds a transmission channel.

Many leverage structures funded the software and service ecosystem at valuations that assumed stable recurring margins.

As those margins come into question, the financing stack becomes more sensitive.

This is a structural shift in how economic rent is perceived.

Infrastructure suppliers sit closer to scarcity.

Intermediaries sit closer to substitution risk.

Execution Bias

Favor ownership of scarce inputs… compute, fabrication capacity, grid access, networking hardware.

Avoid platforms where automation directly compresses fee spreads.

Energy Policy Adjusted Forward Supply Following Conditional Venezuela Licenses

The third mechanism was supply signaling.

The framework remains conditional and revenue routing stays controlled, but forward supply expectations adjusted immediately.

Crude weakness reflects that recalibration alongside prior surplus forecasts.

If incremental Venezuelan barrels materialize while global demand moderates, the oil bid becomes harder to defend into Q2.

At the same time, electricity demand tied to data center load continues to rise faster than headline inflation.

Oil trades barrels and inventory.

Utilities and infrastructure trade sustained load growth.

The market now distinguishes between near-term hydrocarbon pricing and longer-cycle power economics.

Execution Bias

Separate spot commodity weakness from structural demand exposure.

Allocate to utilities, midstream, and grid-linked assets where pricing leverage follows load growth rather than inventory cycles.

FROM OUR PARTNERS

This week, something interesting came up in conversations with top crypto hedge fund managers.

They’re seeing three major forces align:

Institutional money pouring in through new ETFs

Regulatory pressure easing

Technical signals not seen since the last major cycle

What surprised me most?

Many believe individual investors actually have an edge right now — able to move faster and position ahead of big money.

I’ve pulled these insights into a clear crypto retirement blueprint, outlining how smart investors are preparing before the wave hits.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

TAPE & FLOW

Stability Returns While Leadership Does Not Reset For Equities

The rebound in the index obscures the more relevant signal: relative positioning held.

Defensives maintained sponsorship.

Staples and utilities retained steady bids.

Semiconductor equipment extended gains following constructive guidance.

Select cyclicals benefited from rate stability.

Brokerage and insurance platforms struggled to reclaim broken levels.

Commercial real estate operators trade with elevated implied volatility, reflecting sustained margin uncertainty rather than one-day panic.

Credit spreads held firm.

No systemic widening emerged.

Volatility eased from Thursday’s spike but remains above early January levels.

Skew stays bid, indicating ongoing demand for protection beneath the surface calm.

This is not broad liquidation. It is targeted replacement.

Capital is not exiting equities. It is upgrading them.

Index participation improved modestly, but leadership remains concentrated in capital-intensive segments.

The rally lacks symmetry.

It favors infrastructure continuity over service-layer recovery.

Execution Bias

In high-dispersion environments, prioritize risk-adjusted selection over index exposure.

Pair long positions in infrastructure and energy with disciplined avoidance or tactical hedges in labor-exposed intermediation.

POWER & POLICY

Supply Expansion Meets Infrastructure Constraint In The Global Market

Energy policy shifted incrementally toward supply accommodation.

The Venezuela licenses signal willingness to increase available barrels under structured oversight.

This reduces immediate geopolitical premium without deregulating flows entirely.

Simultaneously, domestic power infrastructure faces rising load from AI buildouts.

Utility pricing reflects that pressure.

Capital expenditure in grid modernization and generation capacity will need to expand.

These two dynamics interact.

Electricity markets respond to multi-year infrastructure commitments.

One trades on policy headline velocity.

The other trades on physical constraint.

The Fed transition window between late spring and early fall remains a latent uncertainty.

CPI bought time, but leadership changes at the central bank can alter communication cadence even if policy remains stable.

That window introduces optionality without immediate repricing.

Capital markets continue absorbing heavy AI-related issuance.

Spreads remain contained, suggesting robust demand.

The equilibrium depends on continued appetite for long-duration credit tied to infrastructure buildouts.

Policy risk is procedural rather than disruptive.

Funding conditions remain functional.

Operational constraints are the longer-term variable.

Trade Implication

Model energy and infrastructure policy as medium-term input volatility rather than short-term shock.

Maintain exposure to domestic power and grid beneficiaries while monitoring credit spreads for early signs of issuance fatigue.

FROM OUR PARTNERS

Buffett, Gates and Bezos Quietly Dumping Stocks—Here's Why

The world's wealthiest individuals are making huge moves with their money.

Warren Buffett just liquidated billions of shares. Bill Gates sold 500,000 shares of Microsoft. Jeff Bezos filed to sell Amazon shares worth $4.8 billion.

What is going on? One multi-millionaire believes they are preparing for a catastrophic event. But not a crash, bank run, or recession. It’s something we haven’t seen in America for more than a century.

ONE LEVEL DEEPER

Semi Equipment Leadership Confirms Capital Commitment To Physical Infrastructure

The reaction in semiconductor equipment clarifies the current regime.

Guidance strength translated into sustained sponsorship rather than fleeting relief.

This reveals that capital commitments in the physical AI layer remain intact.

Fabrication capacity, tooling, and advanced process equipment sit at the bottleneck of compute expansion.

As long as that bottleneck persists, order books carry durability.

But durability is not immunity.

If hyperscaler capex guidance slows even modestly, equipment multiples compress quickly because the market has already priced perfection.

Contrast that with advisory and workflow platforms tied to labor-intensive revenue.

There, incremental AI capability competes directly with human-based margins.

The divergence outlines a capital allocation map.

Funds migrate toward assets embedded in physical scarcity and away from models dependent on friction.

The buildout finances the disruption.

Capital flows follow that logic.

Edge Setup

If yields remain contained and semi equipment leadership persists, the long-infrastructure versus short-intermediation framework broadens.

Invalidation emerges if order growth slows materially or credit spreads widen.

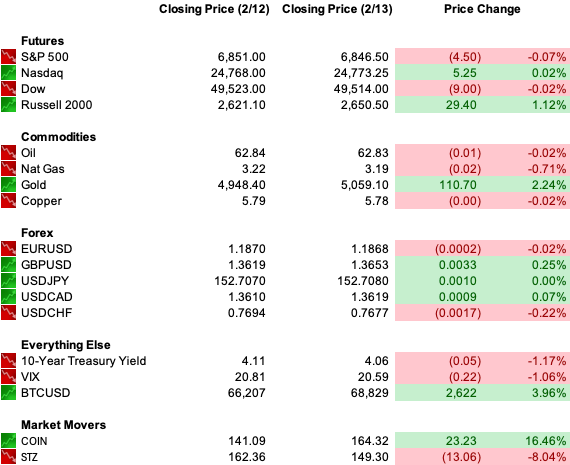

U.S. MARKETS CLOSE

THE CLOSE

The inflation overhang receded. The filtration did not.

Rate stability bought time. It did not repair broken business models.

The fork ahead is clean.

If capital continues to favor scarcity and infrastructure, dispersion widens and intermediation weakens further.

If earnings clarity proves margin compression overstated, the recovery broadens.

Until that evidence arrives, capital will default to physical leverage over fee leverage.

Stay aligned with scarcity.

Treat service-layer rebounds as tactical.

Respect that this is a sorting regime, not a relief regime.